0

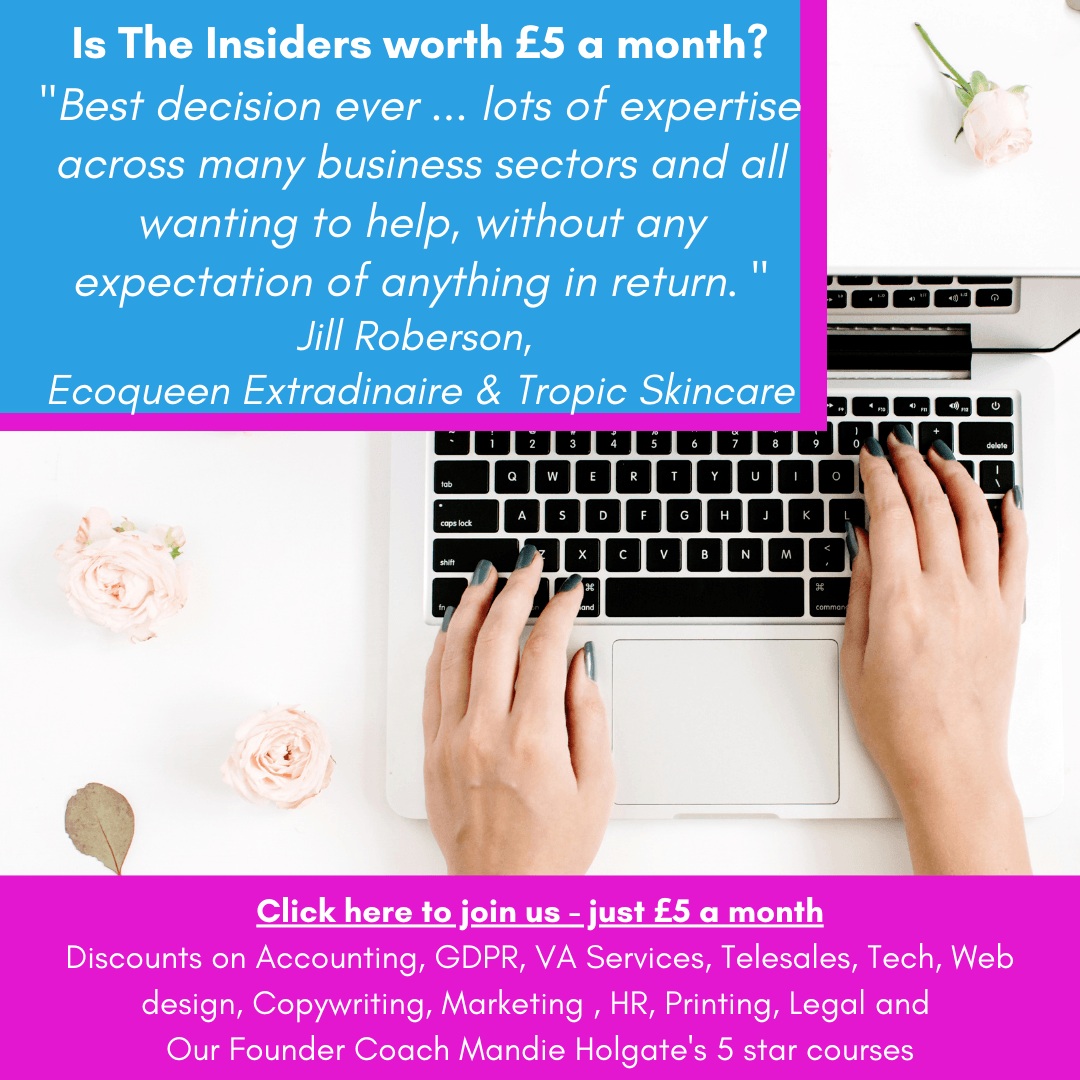

Our latest affiliate is Go Simple Tax who are offering our mastermind group (The Insiders – learn more here) a 10% discount on all of their packages. They will also be writing for us so together we can help you stay up to date on what you need to do….

For those that are

new to the Self Assessment tax return process, payments on account are one of

the most common stumbling blocks. Despite being introduced as an initiative to

help taxpayers spread their tax payments, it often results in annual

frustration and can actually harm your cash flow if you’re caught unaware.

That’s why, in

response to the COVID-19 pandemic, HMRC announced that they would allow

taxpayers to defer their second payment on account (that would have normally been

due on 31st July 2020). It is hoped that this gives taxpayers the

chance to prepare. But is that the right course of action? We’ve brought in

Mike Parkes from GoSimpleTax to set the record straight.

What is a payment

on account?

Payments on

account are advance payments towards your next tax bill. They’re calculated

based on the amount that you paid the previous year.

HMRC splits this

amount into two, and places the deadline for payment six months apart from one

another. For the 2019/20 tax year, the first was due by midnight on 31st

January 2020, and the second would normally be made by midnight on the 31st

July 2020.

This latter

payment is what can now be deferred, as long as it is eventually paid by the 31st

January 2021.

If you had a £5,000

tax bill for the 2018/19 tax year, for instance, you would need to make two

£2,500 payments on account towards your 2019/20 tax bill.

But if your 2018/19

Self Assessment bill was less than £1,000 or if over 80% was deducted at source

(such as employment), then you will not need to make a payment on account – you

would simply need to pay any outstanding tax by the 31st January.

What are your

options?

If you are

required to make payments on account, you will still need to pay your second one.

Although, as HMRC has offered taxpayers the opportunity to delay this, you can

choose to make your second payment as late as the 31st January 2021,

alongside the submission of your Self Assessment tax return.

HMRC will not

charge any interest or penalties should you choose to do this. However, by

delaying your second payment to January, you do run the risk of having to

fulfil all your tax responsibilities at once. This could result in you having

insufficient funds in place to cover all your tax liabilities.

Your therefore have

three options:

Pay in accordance with the

original July deadline

If you can afford

to pay your tax bill as you would do normally, you should do. If anything, it

creates a sense of ‘business as usual’ in an otherwise tumultuous time.

I appreciate that,

for many, paying in July will harm their cash flow. However, it is my view that

clearing debt where possible is more sustainable and allows January to mark the

start of a new financial year – and a fresh start.

Reassess and reduce liability

If you’re doubtful

that you can afford a second payment on account right now, calculate your

2019/20 tax liability before the 31st July 2020. This will confirm

the actual amount to be paid in July 2020, January 2021 and July 2021, and give

you clarity. To do this, you need to file your 2019/20 Self Assessment tax

return early.

Filing

early won’t mean that you have to pay your tax bill early, after all – but it

does allow you to determine what your total tax bill will be ahead of time. From

here, you can consider two key points:

- Does the July 2020 payment on account need

to be deferred?

- Do the January 2021 and July 2021 payments

on account (for the 2020/21 tax year) need reducing to reflect the impact that

COVID-19 has had on them?

Defer to later in the year

Of course, there

will be some cases that are unable or unwilling to pay anything towards their

tax bill in July now that they can defer. In this instance, it’s important that

they are reminded of the Self Assessment late penalties should they wish to

push this all the way back to 31st January and be unable to make

payment at that time.

Deferring

could have an impact on cash flow in 2020/21. If you are also VAT-registered

and have deferred your VAT payment, then it is worth noting that this also

needs to be paid by 31st March 2021.

Ultimately, it

falls to you to make the decision that best suits you. However, it is my view

that, by planning your 2021/22 payments now, you will be in a much safer position.

About

GoSimpleTax

With GoSimpleTax, business owners can get a clear picture of their obligations. All your income can be logged in an easy-to-understand format, and their software will highlight areas where you can potentially reduce your tax liability through tax relief.

Register for their free

trial today and stay abreast of all the

latest tax changes. When you’re ready to file your Self Assessment tax return,

upgrade to their full service and submit straight to HMRC.