Marketing follow up – the fine line between powerful follow up and breaking the law!

All members of our mastermind group and networking events can write for our blog free of charge. Here Robyn Banks from Adavista Data Protection talks about “MARKETING FOLLOW UPS – BE CAREFUL!

Whilst it is very important – as Mandie keeps quite rightly reminding us – to follow up on approaches to prospective clients, you need to be mindful of certain “rules” in place.

Why am I writing about this? Because there is a very fine line between what is OK and what the recipient may interpret as harassment.

You should always remember that you don’t know what sort of a day your “recipient” is having – you could just be that last phone call/email that pushes the “now I’m really irritated and just had enough” button!

So – if you have had a preliminary “conversation” – by phone or email but its been a two way exchange – then you can legitimately contact them to follow up on this.

EXAMPLE – I have been contacted by two Insiders recently (you know who you are!) with a view to having a chat around my field of expertise. In both cases we have struggled to find a mutually convenient time – but I can legitimately contact both to try again!

BUT if I have received something out of the blue from someone that I don’t know, I have not responded in any way, and they send me a follow-up email which starts “just checking to see if you got my email”… or “I sent you an email last week”…Oh dear! Because I have not responded, these follow up emails are illegal as my lack of response should be regarded as withdrawal of consent to contact me.

I did tell you there is a fine line between doing this legally or illegally – probably not what you want to hear.

If all I have done is cause confusion, I apologise because that was not my intention. I want to ensure you get this right and avoid costly mistakes. If you want to discuss this further, then we can discuss this further at a BWN networking and business growth event, straight away on The Insiders confidential mastermind group or contact me here – As an Insider, we already “know” each other so its fine to get in touch. Thanks BWN for the opportunity to share my expertise with our members and women in business.”

If this has made you nervous of what you can and can’t do, don’t stop marketing your small business, talk to us. There are lots of ways we can help ensure your marketing communicates to the right people and leads to new business. Our Founder Mandie Holgate has been helping businesses to thrive through pandemics, recessions, global changes and more for over 25 years an is an active member of our mastermind group so you can ask her anything!

Follow up when done effectively will help your business grow and gain new opportunities.

What You Need To Know About Keeping Warehouses Cool

All members are welcome to write for our award winning website for business owners, any time. It’s a free service we give to members. To learn more click here. (Non members pay £75 per article – discounts apply for multiple articles.)

Managing a warehouse space isn’t easy. There are many things to monitor, and occasionally, some oversights occur.

Though warehouses are in increasing demand due to the surge in online shopping, that doesn’t mean business leaders should lose their grip on the real world. These spaces require careful management practices, especially when controlling temperatures in the workspace.

Warehouses must be kept cool at every juncture without exception. But why is this so important? What are the best solutions to ensure this happens?

Here’s everything you need to know about keeping warehouses cool.

Why Keeping Warehouses Cool is Important

If you’re managing a warehouse, you must ensure it stays cool. There is a lot at stake in doing so.

The priority should be maintaining workers’ well-being. Managers need to be mindful of how working in extreme heat can affect those performing strenuous tasks. Heat exhaustion can be caused. Additionally, employees may experience rapid fatigue or in their discomfort make mistakes that lead to accidents and injuries.

There is also the case of keeping stock in good condition. Certain products like food or pharmaceutical items will need to be kept cool, and any excessive heat can ruin them. They may be unusable, or the consequences of inaction may only be apparent once the goods are in the customer’s hands. Then, the business will likely lose them forever.

Excessive heat in a workspace can also lead to damage and disruption on-premises. Warehouse safety measures are enforced largely by safety information. However, these labels can start to peel away or even shrink in extreme temperatures. Keep an eye out for these subtle signs of temperature change, as it can lead to far bigger problems later on.

What Are Potential Solutions

Now you’ve been reminded of what’s at stake, you’ll appreciate that there can be no half measures when keeping warehouses cool. Considerable investments may need to be made, but you can be confident that they will be worthwhile.

Some people might use air conditioning or industrial fans to cool their warehouse workspaces. While some results can be achieved here, it tends to be evaporative coolers that achieve the best results. Fortunately, this guide on how to cool a warehouse outlines the options available in more detail. It explains that evaporative coolers can cool larger and more open spaces. Installation is also easier, with lower running costs and reduced maintenance periods as well.

Warehouses can have many moving parts to manage that can become overwhelming in time. Therefore, it’s important to implement the best solutions possible, if only to make your life easier in keeping things running effectively. Evaporative coolers are surely the most straightforward answer to keeping the warehouse cool.

Some sources recommend keeping doors and windows shut to trap the cold air and retain it longer when keeping a warehouse cool. However, you can leave them open if your warehouse has an evaporative cooler installed. It’s a small perk, but it can help ventilation and make an industrial workspace feel more open.

You should consider switching labels around to solve the peeling problem in heat-related emergencies. For example, investing in thermal transfer labels can help solve the issue. Polyester, polyimide, and polypropylene can all withstand higher temperatures.

Working with the public sector – what you need to know

As an Insider you can write for our blog free of charge. Here business owner and affiliate Robyn Banks from Adavista

“So you want to work with the Public Sector…

Just as we all started to get our heads around “data protection”/”GDPR” – European and UK versions, and “freedom of information” – the Government announced through the Queen’s Speech on 10th May 2022 that they have reforms in the pipeline. However, to date, I am struggling to find any details on the proposals and it wont be law for a couple of years, so I have time…

BUT this is what I do know! – it will become easier for small business (presumably sole traders) to tender for contracts with public authorities, such as schools, NHS trusts, councils etc. This is good news and should reduce the amount of bureaucracy involved.

If this is something that you are interested in exploring for your business, then we should have a chat because;

The first thing you need to do is discover if the public authority you think will be interested is actually able to work with you. I had a client who was a complimentary therapist. Whilst he was adamant that the Trust would benefit from his services for their patients, the Trust ended up taking him to the ICO who in turn took him to Court.

All of this could have been avoided as I found out from the Trust that they have a policy of never working with complimentary therapists – regardless of what the services are.

The new legislation may make this kind of policy obsolete to open up opportunities for sole traders in all fields.

BUT until then, its best to find out first!

We can make a “Freedom of Information “Request on the public authority and find out. They are not allowed to charge for providing the information when it is a small amount of information as this would be. They cannot hide the information without very specific reasoning. If you would like to take this further, then don’t attempt to go it alone. It’s much easier employing someone like Adavista who are experts in ensuring this is handled in a way that can progress the opportunity to work with the public sector.

I can appreciate that many aspects of my work can seem daunting. Insiders will tell you that within a few hours and for often a very small budget Insiders have been able to ensure their company is legal, secure and handling data correctly. This then can be very advantageous to business growth too.“

To learn more about how Robyn and her company can support your small business to ensure you are compliant and not at risk from fines (Did you know not being registered with the ICO can lead to a £400 instant fine?) click here.

As an Insider you get a discount to work with Robyn’s company, greatly reducing the cost to becoming a fully compliant small business owner. Robyn is also an active mastermind group member so is often on hand for instant advice too!

Health & Safety in the Workplace: Construction

The number of accidents at work within the construction industry is often higher than in other industries. Frankly, it is not hard to see why the threat to your safety is clear between the hazardous environment and risks. That being said, there are a few things that you can do, especially if you are in a management position, to ensure your own health and safety and that of those around you. Keep reading to find out more.

Become a Role Model

First things first, you should always lead by example if you want to encourage others to take their health and safety seriously when working on a building site. Always use the best tool in order to reduce your risk of injury and encourage others to do the same. As a worker, you might be asking yourself, ‘Do I need a construction phase plan?’ and the answer is every job site needs one, but unless you are in a management position, it is not your responsibility to create it. However, they are a great resource when it comes to keeping yourself and others safe.

Increase Awareness

One of the best things that you can do for your health and safety and others is to increase awareness of the risks. Everyone needs to be aware of the potential dangers they face on-site to avoid them. Risk assessments can come in handy here, as can regular training refreshers too. Practising good spatial awareness can also help to ensure that you are aware of what is going on around you and, therefore, less likely to stumble into any hazards.

Wear the Right Safety Gear

The next thing that you need to consider when trying to protect your own health and safety on a building site is whether or not you are wearing the right protective gear. A number of hazards on a building site can be mitigated with the right safety wear. For example, falling debris could be fatal, hence the use of hard hats. Dropping heavy things could lead to broken bones in your feet which is where steel toe capped boots come in. If the other workers can’t see you, then there are more likely to be accidents, which is why you should always wear a hi-vis. Consider your job on the site and what pieces of gear you should be wearing.

Follow Procedures

The management team on your site will have put together health and safety procedures for your well-being and the well-being of everyone on the site. Make sure that you have been trained on these procedures and that you understand the importance of them and when they apply. Then, take them on board because they can affect not only you but everybody else on site too.

Summary

All businesses are legally obliged to protect the health and safety of their employees. However, the nature of the construction industry does mean that there are perhaps more hazards to look out for. This is why educating yourself on the hazards and risks on the worksite is important. Be sure to take steps to protect yourself.

Did you know you can write for our blog free of charge as an Insider. The INsiders attracts professionals from all industries, not just business owners. Men and women interested in sharing their knowledge, learning and mentoring as well as gaining new business. Do join us.

Learn more and sign up here

The true cost of cheap supermarkets

Insider and BWN Business owner Paul Boorman, is a top masterchef of Great Britain, a highly successful award winning Executive Chef with a demonstrated history of working in the hospitality industry and an interactive member of our matermind group. We all have expertise over on the INsiders and as business owners we are all happy to support one another.

Here Paul outlines some very unsavoury facts about your local cost saving super market. If you are eating, you may wish to stop!

If you are a business owner, you may wish to share this post and shout about what Paul has to say.

“Supermarkets, not very super…

So let me be very clear about this. I do not think that the pandemic of Covid 19 was an intentional act to bring about some kind of new world order but I do know that Tesco made £1k million more in 2020 and £4k million more in 2021 than in 2019.

Let me pose a few situations that I can’t quite get my head round.

During Covid lockdown times a pub was not allowed to sell alcohol either on premises or to takeaway. Millions of pints of beer and other drinks were poured away with no recompense from the Covid Support packages. With all Covid precautions in place it was perfectly feasible for a pub to sell cans, bottles, and containers of the nation’s favourite tipples outside with social distancing and contactless payment all observed, but this was not allowed.

The bastions of social gathering and lubrication with a history older than the USA were held out to dry, whilst supermarkets whose often used tactic of selling beer cheaper than its cost price was allowed to have several hundred people inside at the same time all clamouring for toilet rolls and bottles of wine.

Pubs were allowed to sell food, but not alcohol… To suggest that there might have been some closed-door discussion about the Big Business guys taking advantage of their connections to ensure that they had a monopoly on supplying the dramatic increase in consumption of the countries favourite legal drug would be pure speculation.

Pubs weren’t even allowed to deliver alcohol but one of my strongest memories of driving on the eerily deserted roads during Lockdown 1 was the number of supermarket delivery vans out and about. As I said, I don’t believe that the pandemic was intentional but Big Business certainly took advantage of training the population to have everything delivered to their door, to the exclusion of small independent traders who just couldn’t compete. ‘But they can always use Deliveroo, Just Eat and the like’ I hear you cry (not really but I’ve always wanted to write that line).

Which brings up another concerning fact. When you watch the adverts for Just Eat they only mention the Big Business brands such as GREGGS, MacDonalds etc, never that you can get your local Joe’s Burgers, or Blackcurrant Bakery sausage rolls. Unremarkable you may think in and of itself, but it falls in a different shade when you compare the fee percentages that Big Business pay to use the platform compared to small independents.

The like of KFC, MaccyD’s etc will pay somewhere in the region of 8-10% perhaps a little more, maybe a little less whilst Joe’s Burgers will pay between 30-35% for the same service.

But is it even the same service?

Take a look on these apps and see which business are consistently promoted front and centre. Big Business with the highest profit margins paying the least fees whilst the small business are paying crippling fees just to compete. But that’s a level playing field and therefore nothing to complain about, isn’t it?

So Big Business bring more business must surely be the answer to the discrepancy in fees, although I doubt that the amount that small places get charged makes up the difference.

But supermarkets give us convenience don’t they, and with their ‘price wars’ we get great value for money don’t we. Far cheaper than the little shops who charge far more aren’t they!

Sadly, many people believe this, and we have certainly seen plenty of fish and veg mongers, butchers, hardware stores and corner shops disappear from our declining high streets.

So what is the true cost of this ‘convenience’?

Well, the easiest answer is quality of the goods we buy, especially fresh food goods. I recall having a very strange discussion with a very smug supermarket manager last year. I had bought 3 packets of chicken wings late one night on the way home from work. The following evening, I decided to marinate them ready for the BBQ and whilst they were all in date, the packet with the longest date on them had ‘blown’ overnight. This is caused by hydrogen sulphide that is produced by the decaying meat. I foolishly pierced the packing and immediately regretted it. The stench was retch inducing.

So, I decided to return to branch of this supermarket which is actually one of their flagship stores. Eventually the manager agreed to meet me as I refused to leave and told everyone why I was there. To cut a long story short I spent 10 minutes listening to the most incredible claims by the very smug manager. According to him not only was he not going to inform anyone (Environmental Health Officers was my suggestion) about this issue, but he also informed me that supermarkets are allowed by agreement with the government to sell an ‘acceptable’ amount of food not fit for human consumption!

I will say that again. Supermarkets are allowed to sell food unfit for human consumption.

Paul Boorman

When I commented that people could get ill, he told me that people overcook food anyway so it would be fine. All he had to do was offer to buy the food back. He then pointed to the fish section saying that none of the fish was fresher than 3 months old and he certainly wouldn’t buy any of his own fruit and veg! The fruit and veg is stored in massive warehouses kept at the exact sub-zero temperature that preserves the product without actually freezing it.

Ever wondered why the fruit and veg goes off so quickly when you get it home? That is 3 months of decay catching up literally overnight.

What is the true price of your weekly shop at the supermarket then?

Is it as cheap as the till receipt says? Well, factor in the amount of fruit and veg you throw away and the true cost starts to increase. Check the added ingredients in your pork shoulder roasting joint, ‘added water’? That’s going to change the price per kilo price isn’t it. You only want 2 chicken breasts, but they come in packs of 4?

It is useful to remember that a large corporation has a different time scale perspective as well. Small businesses are normally owned by one or two people and so have a time view of a few years at a time. Certainly not beyond retirement age of those concerned. Big corporations are run by a board or similar and have timescales of decades. They can be patient, slowly squeezing the little businesses out with their pricing and ‘convenience’.

However, truly the saddest part of all this is the unseen cost to the local area. Profits and taxes from Big Business go out of the area. The profits go to head office and get spent by those in control on yet another holiday in the Maldives, maybe not entirely accurate but you get the idea.

The ratio of taxes they pay is miniscule per pound taken compared to the taxes paid by small business per pound. The local rates are often heavily subsidised by the council just to have the privilege of yet another chain coffee shop, whilst small business gets clobbered to make up the shortfall.

But think of all those local jobs! Not really..If the small coffee shop was busier they would need more staff, as would that local butcher or veg shop. When was the last time you saw an independent Off License? The jobs are created where ever you shop. Let that sink in.

The very saddest part is that the owner of that small shop that you choose not to shop in lives in your neighbourhood, their kids go to the same school as yours do, they pay council tax, local rates, shop locally keeping their hard earned money in the very local economy. They even raise money for local charities! But only for so long as they can keep their business open, and for that they need customers….”

A powerful article on the true cost of cheap and it’s damage to our towns and cities. Every consumer can make a difference. As we see more high profile people get away without paying fairly their taxes, remember SMEs account for three fifths of the employment and around half of turnover in the UK private sector. Total employment in SMEs was 16.3 million (61% of the total), whilst turnover was estimated at £2.3 trillion (52%).

Time to rethink your shopping habits?

If you buy local and talk about it on Instagram great tags to use are #supportlocaluk #smallbusinessuk #supportsmallbusinessuk and don’t forget to tag us – @https://www.instagram.com/thebusinesswomansnetworkuk/

All Insiders can be published on our site free of charge. To learn more click here.

Side hustles – how to overcome the cost of living hikes (without putting your prices up or selling a kidney!)

As a business owner you can’t help but question how you will sustainably grow your business without putting your prices up as the cost of living goes up again and again.

I really feel for the public sector who don’t’ even have the option of pushing themselves harder to increase their income.

So with that in mind we asked our confidential mastermind group about their plans for making more money without having to work 24 hours a day. (Usually we wouldn’t share details of conversations on the Insiders because it’s a confidential place to talk business, life as a business owner and gain new business but we thought with their permission we would make an exception for this important subject) and we were interested to learn how many Insiders had created automated passive incomes and side hustles (not a term I’m keen on, makes me sound like a cowgirl!)

It’s a big passion of mine to create automated incomes and I’ve helped a lot of clients achieve this too, so that they can earn money while they are busy doing something else.

I love opening my bank account and discovering I’ve made money without doing anything – for me I have courses, books, affiliations, Hemp (random I know) and blog donations as my automated income. I thought it would be great to hear from our Insiders and shamelessly promote them and share what they’ve found to help them make more money and thus not have to put their prices up impacting on their customers too.

As Robyn Banks put it (no that’s not her job!) we have fingers in many pies, and it’s good to hear.

Robyn is the owner of Data protection specialists Adavista but when her and her husband are not running that business, they are making celebration cakes, hosting and building websites and helping Lions International with all their data protection needs.

Helen Watson’s day job is as a counsellor specialising psychotherapies, CBT and EMDR, not surprising that due to the pandemic and very real fears around the world Helen has never been so busy, with 2 busy practices in Maldon and Colchester, Helen also rents out rooms to therapists and small businesses in the area.

Helen told about her passion for Neal’s Yard Remedies Organic “For me, I value the power of essential oils to support clients as part of a holistic approach to mental wellbeing, we also use some of the NYRO products like hand washes, hand sanitiser etc at both Colchester and Maldon consulting rooms.

We try and use products in the business that are ethical and eco-friendly because that’s important to us – and the blue bottles are just one of the ways we of do that plus potential to earn a little extra. (Though I’ve stopped offering hands-on treatments myself, there’s also ranges for beauty and massage therapists to use in their treatments so can be worth joining for various therapists.) To learn more about Helen and her businesses click here.

Jill Roberson is passionate about small businesses appreciating the value of being a green eco friendly company and often shares advice to the Insiders on how to achieve this. Her side hustle as a Tropic Skincare Ambassador not only brings in an income it also helps her team.

Jill told us “It’s very important to me that I work with ethical companies. Tropic freshly make their products in their own cosmetic kitchens near Croydon, using only plant and mineral based ingredients. It’s really important to me that they’re a carbon negative company and that every product helps provide primary education to children in remote parts of the world.” Check out Jills’ eco approach to skincare here. Jill even offers online pamper sessions for you and your friends – now that’s clever thinking!

For Karen Boughton the day job is all about VA services. Helping busy business owners find additional time and takin gall the jobs they hate, Karen said that she joined Tropic not to set up another business but because of the discounts she gets. Well saving money is another way you can keep more profit, right?

Clearly Tropic Skincare is a popular option for the side hustle since Claire Martine is an ambassador too.

“I have been a Leader with them for a year and a half, joined as an ambassador only 3 years ago.

I love all the decisions behind the brand that support its ethos to create a healthier, greener, more empowered world. Teamed with the proven efficacy of the products, I was happy to stand alongside a brand that not only promoted clean and natural products to my friends and customers with real models, but it’s wonderful to support so many charities effecting change and people’s lives globally. To be able to guide and inspire others in their Tropic journey is just the best

No targets, no minimum earning must, no pressure. The vibe is very supportive and high morale. I did it as my full-time venture until I completed my master’s degree, I now have a part time role alongside this.” We’ve seen this first-hand with Lisa Hardy often bringing other Tropic ambassadors to our events so that they could grow their businesses. It had no benefit to Lisa but it’s about spreading the business love right?

For Daliah Hopcroft, when Dahlia’s is not teaching people how to love telesales or phoning on behalf of business owners who hate it is a Forever Living consultant. Daliah told us “I first discovered Forever when I was unwell with an infection on my leg and a friend suggested using Propolis cream and I was blown away with the results and I’ve used them on myself and my family ever since. Their products harness the amazing benefits of Aloe Vera to improve health and wellness. They also have an award sinning skincare that I’m in love with too.

Tracey Fordham meanwhile may be known for her absolutely incredible Victorian inspired cake creations but her passion for holidays is now bringing in money too. “I’ve travelled around the world, and love helping people get the very best holiday on whatever size budget they have. It’s been really tough through the pandemic but rewarding to know that our customers were well protected. Working with Not Just Travel has been an amazing experience for me. I feel like I’m holiday with my clients every day!” Click here to check out some beautiful holidays.

Sally Anderson Wai maybe a journalist of many years with a good few years working at the BBC, but when Sally is not writing copy, blogs or social media content for clients Sally also owns a dog walking, day care and holiday cat feeding services in North Essex.

“I adore animals and it means I can spend my spare time loving other people’s pets. It’s a great job and I often get inspiration for my PR and copywriting clients when I’ doing it too!”

Helen Tovey is a life coach that specialises in helping people with body confidence “It was a natural addition for me to join Synergy and build a team – the products are award winning, and my customers tell me they feel it helps with their immune system, boosting energy levels and many other benefits. I know we talk on the Insiders about legal ways to promote products like these and it’s great to share so many stories from customers. It’s lovely to help others be physically well and love the bodies they are in!” Check out Helen’s day job here.

Paul Boorman is the owner of White Label Detroit Pizza – it may sound bizarre, but they specialise in moorish pizzas that are as good (no better) than takeaway, but you cook them at home. Paul sells raw Pizza across Essex, Cambridgeshire and Suffolk (and they are growing fast – well who wants to wait 2 hours for a takeaway to turn up?) but when Paul is not making Pizza, he is a consultant to the leisure and tourism industry and delivers fine dining in your own home. It doesn’t come cheap but since Paul is one of the top chefs in the UK, it’s an experience you never forget. Try not to saliva over your tech as you look at these pics of Pauls food! You can see if WLDP deliver to your area here. We think Paul would travel anywhere to give you the gourmet chef experience as long as you are playing for the fuel/flight/boat to get him there. Learn more here.

Hungry?

If these ideas have whetted your appetite for a side hustle join us on the Insiders to learn more and discuss what you could do to boost your income.

We are a friendly group of business owners of all sizes and industries coming together to support each other through tough times and exciting ones, challenges and growth. No subject is off limit the only rules I insist on are;

1. Don’t mention a business/product/service if you have not personally used it.

2. Don’t share links to your site/social media/landing page unless you are looking for confidential feedback and advice on how to make them work better. This we actively encourage and Insiders are always happy to share ideas and advice.

3. Don’t DM Insiders with advice and ideas, keep it in the confidential Facebook page then everyone benefits from your knowledge and can come to you for advice, and you gain new business. We see conversations from 2018 pop up with new comments as people use the FB group as a source of information and ideas for their business.

If you would like to join us, we’d love that, please feel free to share this article with your friends and social media world and let’s keep talking on the Insiders. As the Founder of The Business Womans Network and a coach I’ve helped over 10,000 businesses to grow. They range from pre-start up through to very large global business. Your business is my passion, it always has been, and it always will be so the more you get involved in the Insiders the more I and those amazing business owners can help you too.

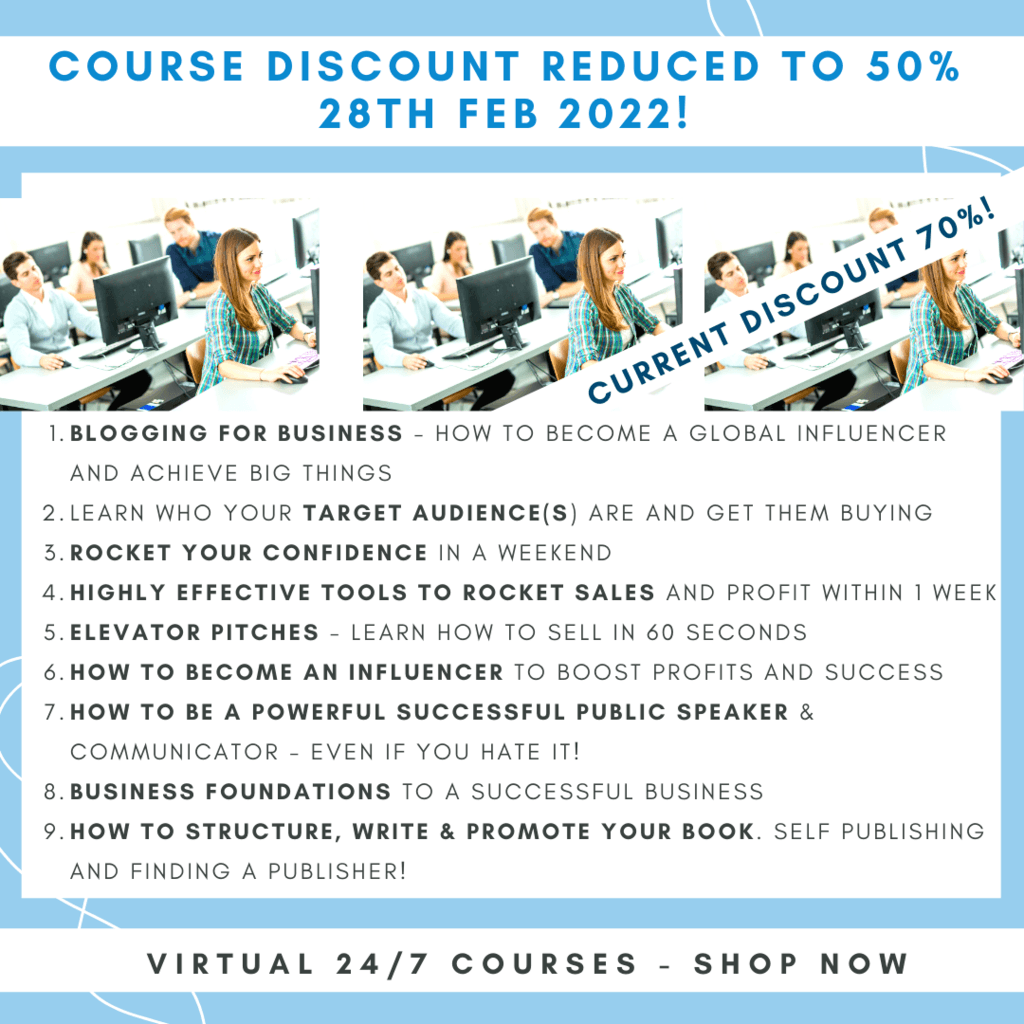

It’s why all Insiders can sell my courses and keep 50% of the profit too. It’s another way to bring in an income with very little effort and when you work so hard in the day job, it’s good to get a helping hand right?

Learn more about the business, confidence writing and communication courses here

And just for the record, we actively encourage our members to put their prices up when it’s right to do so and over on the Insiders we help you work out how to put your prices up and ensure people are happy to pay them. Use the magnifying glass on the confidential mastermind group to access the advice on that.

Disability Confident and Your Business

| Here we share the latest news from Disability Confident. It is free to join and you could make a real difference. If you do get involved please do tag the DC team and us in a post on social media. You can access all of our social media at the top of the page – thank you! Disability Confident – Members’ News February 2022 This is best viewed in your web browser, please click here. This edition includes… RNIB Visibly Better Employer Quality standard Getting WorkFit for World Down’s Syndrome Day Microlink hosting Digital Accessibility events for businesses Way to Work – an introduction for employers To hear for life, listen with care – World Hearing Day Access to Work Mental Health Support Service 3 steps to Level 3 – becoming a Disability Confident Leader Things to remember – check and renew your registration, promote your disability confidence Time is running out to have your say RNIB Visibly Better Employer Quality standard According to RNIB only one in four people with sight loss of working age are in employment. Currently 11,000 people with sight loss in the UK are actively seeking work. RNIB is offering employers the opportunity to work with them, to become a better and more inclusive employer for people with sight loss. RNIB is encouraging Disability Confident employers like you to find out how their new Visibly Better Employer Quality standard will complement and enhance the steps you have already taken to improve your recruitment practices for people with sight loss. Check out the RNIB website today, to find out more. Getting WorkFit for World Down’s Syndrome Day World Down’s Syndrome Day on 21 March 2022 aims to raise global awareness of Down’s syndrome. You can find out more about the day in the UK and how your organisation can get involved through the Down’s Syndrome Association (DSA). The DSA supports people who have Down’s syndrome into work through WorkFit, delivering successful supported employment by finding the right role for the right candidate, with the right level of support. A range of support is provided for employers, delivered by an assigned Employment Development Officer to ensure consistency and strong partnerships. This support includes bespoke training about Down’s syndrome including how candidates can be supported in the workplace, and a range of resources and advice. All support is free and lasts for the lifetime of the placement. WorkFit recently featured on BBC1’s The One Show (from 2 minutes in) and BBC News. You can hear from people who have Down’s syndrome and their employers on the WorkFit YouTube channel, and you can even hear Sting sing about why you should get involved in The Hiring Chain. To find out more email dsworkfit@downs-syndrome.org.uk or call 0333 1212300. Microlink hosting Digital Accessibility events for businesses Disability Confident Leader, Microlink, is hosting events in February and March on digital accessibility. In February’s webinar, Dr Neil Rogers, Microlink’s digital accessibility expert, will explain what we mean by digital accessibility, the business benefits and how to ‘think accessibility’ from the start. He will also be looking at how to ensure your website is accessible and why your documents (such as pdfs, PowerPoint slides and Word / Excel files) need to be accessible for all in 2022 and beyond. Dr Rogers will also be hosting a workshop / clinic on 1 March where you can ask for advice on the accessibility challenges you’re facing. Sign up today. Tuesday 1 March 2022 @2pm – Digital Accessibility workshop/clinic with Dr Neil Rogers, head of digital accessibility at Microlink. Register here: Clinic For more information about Digital Accessibility support from Microlink, check out this Animation or go to www.microlinkpc.com for more free resources about being Disability Confident. Way to Work – an introduction for employers Way to Work is a new partnership between government and employers to get 500,000 jobseekers into work by the end of June 2022. This partnership will help fill record numbers of vacancies, supporting job-ready people into the labour market and helping them progress into a career. If you’re looking to fill a vacancy, Jobcentre Plus will offer you a named employer adviser in your local jobcentre (or a dedicated national account manager if you’re a national employer) and access to a range of recruitment services. Having Disability Confident employers involved will help to ensure jobseekers, including those with disabilities, have the opportunity to access roles with businesses that value diversity and inclusion. Find out more about Way to Work and how you can take part. To hear for life, listen with care – World Hearing Day It’s the World Health Organisation’s World Hearing Day on 3 March 2022. The focus of this year’s event is the importance of safe listening to maintain good hearing throughout your life. The campaign website has more details about events on the day and how you can take part, and further information about safe listening. You can get advice and guidance on noise at work on the Health and Safety Executive’s website. There is also a new free download on controlling noise at work regulations. The RNID also have information for employers on being deaf aware at work and how to support colleagues with hearing loss. Remploy: https://www.remploy.co.uk/employers/mental-health-and-wellbeing Able Futures is running a mental health webinar in March. Anyone can join and you can book through the following link: Friday 18 March @2pm – The importance of sleep on mental health at work. Remploy also run free webinars where you can learn more about the service and how it can benefit your business. The next sessions can be booked here: Thursday 3 March @12pm and Wednesday 30 March @12pm. 3 steps to Level 3 – becoming a Disability Confident Leader If you’ve completed the employer self-assessment and are a Disability Confident Employer (Level 2), you will be thinking about what you need to do to reach the scheme’s top level – Leader. You are only three steps from the summit. These are: challenge; leadership; and reporting. Each of these build on the work you’ve already done. Challenge means you have your self-assessment validated by another organisation, and you confirm that you are employing disabled people. Leadership means describing the activities you are undertaking that show leadership in disability employment, such as, sharing good practice with other employers or hosting Disability Confident-related events. And finally, reporting is about the action you’re taking to record and report on disability, mental health and wellbeing in the workplace (following guidance in the Voluntary Reporting Framework). There is further guidance available on gov.uk or you can take a look at the video on becoming a Disability Confident Leader. Things to remember – check and renew your registration, promote your disability confidence Not sure when your Disability Confident accreditation is due to expire? It’s easy to do a quick check. Your expiry date is on the certificate issued when you joined or when you progressed to the next level. Or you can email the team at disabilityconfident.scheme@dwp.gov.uk if you’re not sure. You can also advise of any changes to your contact details at the same email address. When it’s time to renew your membership, guidance on what you need to do is available on the Disability Confident website. And whether you’re renewing your membership of the scheme or have just joined, don’t forget to tell the world that you are committed to being an inclusive employer. Use your Disability Confident badge in your recruitment information, and your business and customer communications. If you need a badge in a different format, please email your request to disabilityconfident.scheme@dwp.gov.uk. Time is running out to have your say The Cabinet Office’s consultation on workforce reporting on disability for large employers is open until 25 March. Go to theconsultation website if you want to respond. |

Time to panic over Meta/Facebook pulling out of Europe?

Those rumours on Facebook, are they true? What does it mean for your small business?

Here at the BWN, our INsiders benefit from some top experts on business. Here Insider Robyn Banks (Yes really her name) shares advice on the latest rumours on Facebook/Meta pulling out of Europe and what you need to know as a business owner.

Robyn Banks owns Adavista, a company specialising in ensuring you get the law right around data protection and freedom of information. The cost to small businesses of getting this wrong can be fines starting from £400. Every business (with few exceptions despite what you might read on social media) needs to be registered for example with the ICO. Not sure on what you are doing? On our confidential mastermind and networking group, you can ask Robyn anything and you get a discount to work with Robyn too. Not an Insider yet? Join here.

You may have seen lots of articles, even through Facebook, about Meta (Facebook’s parent company) pulling out of Europe. As an expert in this industry here’s my thoughts on this;

Why would they? This market is worth a lot of money to them. There have also posted about Mark Zuckerberg losing a lot of money because people are turning away from Facebook. May be this is a marketing ploy?

Why are they “considering “if the market is worth a lot of money?

Well, this has historical roots! Facebook – as well as Google – have fallen foul of many Information Commissioners across Europe over the years that has resulted in a lot of money in fines! They thought that, as big conglomerates, they could just walk over individuals and their privacy rights! But you should remember that Facebook was never intended to be a “private” medium.. it was supposed to be a digital place to meet people and connect with others – you can’t do that if its only “closed” groups or private!

In an attempt to get round the data protection/privacy rules, Facebook originally set up its storage facility in the Republic of Ireland – ie in the EU. But the “rules” state that, as a US company, they must abide by EU law in an EU country. So when they kept getting huge fines, they moved everything to California.

California is one of the few US States to have a form of data protection legislation, but federally, the US does NOT have data protection legislation to protect the rights of individuals. This is why the “EU/US Privacy Shield” was put in place – an agreement with the US Department of Commerce to protect our rights when dealing with US based companies. This agreement was designated “illegal” and not-fit-for-purpose by the European courts in 2020. BUT if the US entity was not governed by the US Department of Commerce – and many are not! – then it didn’t apply anyway! This meant that the US organisation have to have an Agreement in place with the country concerned using the “Standard Contractual Clauses” drawn up by the EU authorities. This is still the case and there are new Clauses just issued.

All this still applies to the UK after Brexit because our data protection rules have not changed in concept from the EU rules. In fact they have drawn up an “Adequacy Decision” between UK and EU countries because we have the same level of protection on individuals’ rights and freedoms.

What’s next? – well, its simple! Facebook/Meta just need to obey the rules! They can draw up new agreements with European companies they market to (for adverts etc which is how they make their money) using the new Clauses. They need to think about data storage and the individual’s right to delete data.

And perhaps they should think about employing me??!

The important thing to remember that you don’t need to panic, as an Insider I will always ensure you are up to date on the law and any changes that you may need to make. Not sure if you’ve got it right? I’m happy to have a chat either on the confidential mastermind group or via my website.

Don’t miss the Self Assessment filing deadline – and five other last-minute tips for landlords

Article by GoSimpleTax

Time is running out for landlords and other Income Tax payers, with the Self Assessment online filing deadline of midnight on the 31 January fast approaching. Miss it and straight away you’ll have to pay a Self Assessment late-filing penalty of £100.

- After three months, if you still haven’t submitted your Self Assessment tax return, you’ll face an additional £10-a-day penalty, up to a £900 maximum.

- If you’re six months or more late, there’s a further penalty of £300 or 5% of the tax owing if this is greater.

- Those who are 12 months or more late are charged another £300 or 5% of the tax owing if this is greater.

The message for landlords is clear: it’s far better and cheaper to make sure you don’t miss the 31 January Self Assessment online filing deadline. If you haven’t yet started to complete your Self Assessment tax return, you really need to get a wiggle on. To help you, here are five last-minute tips for landlords who need to complete a Self Assessment tax return.

1 Register now if necessary

If the 2020/21tax year was the first year you’ve received taxable income from renting out property, you must register for Self-Assessment online and file an SA100 tax return.

In the supplementary SA105 form, which you submit with the SA100, you detail your rental income and allowable costs/expenses (see below) for that tax year, so that HMRC can calculate your Income Tax and National Insurance liability, which is based on your net profit (ie rental income minus allowable costs), accounting for any income from other sources. HMRC will then send you a bill, which you pay directly. If you need to register, get it done ASAP, so you can get on with completing and filing your Self Assessment tax return.

Need to know!

- The first £1,000 of property rental income is tax-free. It’s called your “property allowance”.

- If your property rental income is between £1,000 and £2,500 a year, contact HMRC for reporting guidance.

- You must report rental income via Self Assessment if your rental income is £2,500-£9,999 after “allowable expenses” (see below) or £10,000 or more before deducting your allowable expenses.

2 Claim all of your allowable expenses

Many costs can be deducted from your rental income to help minimise your tax bill. These are called “allowable expenses” and can include:

- property maintenance and building repairs (eg replacing broken roof tiles)

- redecorating between tenancies

- insurance (eg building, contents and public liability)

- gardening and cleaning services

- letting agent fees/management fees

- legal fees for lets of a year or less

- accountancy fees

- direct costs (eg phone calls, stationery and advertising for new tenants)

- fuel/vehicle costs (only the proportion used when on rent-related journeys).

Replacing baths, washbasins and toilets is allowable as building repairs, but only if the quality is comparable – it can’t be better. If your rental property is furnished or part-furnished, you may be able to claim a tax relief for replacing worn, damaged or faulty domestic items such as sofas, beds, carpets, curtains, fridges, washing machines, sofas, crockery, cutlery, etc, again, again, as long as the quality isn’t higher.

Need to know!

- Landlords used to be able to deduct mortgage interest and other finance costs (eg mortgage arrangement fees) from their rental income to help minimise their tax liability.

- Instead, landlords now get a 20% tax credit.

3 Don’t claim for “disallowable expenses”

You can’t claim for property improvements, such as converting a loft or building an extension, but keep a record of all associated costs, as you may be able to take them away from the sale price to reduce any capital gains tax liability if you decide to sell the property.

As a general rule, costs must be created “wholly and exclusively” generated by renting out your property, if HMRC is to allow them. So, you cannot claim for personal mobile phone bills or vehicle use, as examples.

Need to know!

- Those who deliberately inflate their Self Assessment tax return expenses claims face penalties if HMRC finds out, as well as having to pay outstanding tax. It’s tax evasion.

4 Include all rent-related income

As well as rent, some landlords charge tenants for additional services, which can include renting furniture, cleaning communal areas, gardening services, in some cases, heating, hot water, etc. This income must also be included within your Self Assessment tax return, as does any money you keep from a tenant’s deposit.

5 Manage your losses

If you already need to file a Self Assessment tax return, for example, because you’re a sole trader (ie self-employed) or you earn taxable income from other sources, you must detail all taxable income and any losses made when renting property, even if you make a loss.

A loss happens when your allowable expenses are higher than your rental income, so that you make no rental profit during the tax year. If this happens and you don’t otherwise need to report any taxable income, you don’t need to complete a Self Assessment tax return, if you only rent out one property.

If you rent out more than one property, the income and expenses of them all will be added together to provide an overall profit or loss for the tax year and you’ll be taxed accordingly.

Need to know!

- You can tell HMRC about rental income from previous years upon which you haven’t paid tax. For example, if you didn’t know you were required to.

- Any penalty will likely be lower if you volunteer such information, rather than HMRC finding out with no assistance from you.

- If you’re not sure about whether to declare any rental income, contact HMRC or seek tailored professional tax advice.

If you’re really pushed for time or simply don’t relish having to complete your Self Assessment tax return, services providers can do it for you or give you additional peace of mind by checking a tax return you’ve completed. Moreover, there are apps that can also take the pain out of filling out Self Assessment tax returns.

More information

- Visit Gov.uk for government guidance, help and support for landlords.

- HMRC has published guidance on filling out the SA105 form (PDF).

About GoSimpleTax

Income, expenses and tax submission all in one. GoSimpleTax will provide you with tips that could save you money on allowances and expenses you might have missed.

The software submits directly to HMRC and is the solution for the self-employed, sole traders and anyone with income outside of PAYE to file their self-assessment giving hints and tips on savings along the way. GoSimpleTax does all the calculations for you saving you ££’s on an accountant. Available on desktop or mobile application.

Try for free – Add up to five income and expense transactions per month and see your tax liability in real time – at no cost to you. Pay only when you are ready to submit or use other key features such as receipt uploading and HMRC direct submission.

How to report rental income if you’re a company director

Article by GoSimpleTax

There are 2m limited companies actively trading in the UK, making up about 37% of the total business population (source: Federation of Small Businesses). Some have one company director, while others have more.

Company director income is often made up of a relatively small amount of wages paid through the company payroll, topped up with company share dividend payments, with both taxed accordingly. But what if you’re a company director with income from other sources, more specifically, from renting out property?

If you’re a company director who’s recently started renting out property or you’re considering it, you may be wondering how you report rental income, what expenses you can claim and how much tax you’ll pay. This guide provides a basic overview.

Here’s what we’ll cover

- Whether you need to register for Self Assessment.

- Paying tax on rental income when you’re a director.

- Rental income records you need to keep.

- What expenses you can claim.

Do you need to register for Self Assessment?

If you receive taxable income from renting out a property, you must declare those earnings by registering for Self-Assessment online and filing an SA100 tax return each year.

In the supplementary SA105 form, which you submit with the SA100, you detail your rental income and allowable costs/expenses for that tax year, so that your Income Tax and National Insurance liability can be calculated by HMRC. This is based on your net profit, accounting for your other income. HMRC will then send you a bill, which you pay directly.

You can, of course, rent out more than one property or jointly own a rental property, perhaps with a relative, partner, spouse or colleague, and you’ll be taxed according to your share of the net profits.

• HMRC has published guidance on filling out the SA105 form (PDF). You can also use it to declare furnished holiday lettings in the UK and European Economic Area.

When should you register for Self Assessment?

You can register as soon as you receive your first rent payment and HMRC recommends registering for Self Assessment as soon as possible.

However, you’re only required to register for Self Assessment by 5 October following the end of the tax year in which you received taxable rental payments. If you don’t, you risk having to pay a penalty.

Need to know! The deadline for online filing of your Self Assessment tax return is 31 January, following the end of the tax year on 5 April. Fines of £100 are payable if you’re late.

What rental income records should you keep?

You must maintain accurate financial records detailing all rent received, as well as any payments for additional maintenance or repairs your tenant pays you for, together with specific dates of when your property was occupied by a tenant.

You should also keep detailed records of costs incurred while managing and maintaining the rental property (see allowable expenses below). Recording your income and expenses/costs in accounting software is recommended, because it will save you a lot of time and effort when completing your Self Assessment tax return.

Also retain all receipts and invoices as proof of claimed expenses. There are apps you can get that automatically link to accounting software to update your total outgoings. HMRC can ask for proof of your expenses and go through your bank statements. Records must be kept for six years and you can be fined if your records are inaccurate, incomplete or lost.

Need to know! Keep a log of mileage you drive wholly and exclusively as a result of renting out your property (eg if you need to visit the property), as fuel and vehicle costs can be claimed as an allowable expense.

What allowable expenses can you claim?

Costs must be “wholly and exclusively” the result of renting out your property if they’re to qualify as allowable expenses. You can’t claim for company or personal expenses.

Allowable can expenses include:

- property maintenance and repairs (eg replacing a broken window)

- redecorating between tenancies

- insurance (eg building, contents and public liability)

- gardening and cleaning services

- letting agent fees/management fees

- legal fees for lets of a year or less

- accountancy fees

- direct costs (eg phone calls, stationery and advertising for new tenants)

- fuel/vehicle costs (only the proportion used for your rental business).

Replacing domestic items such as baths, washbasins and toilets is allowable, because they’re classed as building repairs, but only if you replace like for like (ie the quality must not be superior).

Similarly, if your rental property is furnished or part-furnished, you may be able to claim for replacing worn, damaged or defective sofas, beds, carpets, curtains, fridges, washing machines, sofas, crockery, cutlery, etc, as long as the quality is of comparable value, not superior.

Landlords used to be able to deduct mortgage interest and other finance costs (eg mortgage arrangement fees) from their rental income to reduce their tax liability. But now you get a tax credit of 20% instead.

Need to know! You can’t claim allowable expenses for property improvements such as building an extension, but you may be able to subtract these costs to reduce your capital gains tax bill if you sell your rental property.

How much tax will you pay?

The standard tax-free Personal Allowance is £12,570 (2021/22 tax year) if you earn less than £100,000 a year. The Income Tax rates are different in Scotland, but in England and Wales:

- If you earn between £12,571 and £50,270 a year, you will pay 20% Income Tax (Basic Rate) on your taxable income.

- If you earn between £50,271 and £150,000 a year, you will pay 40% (Higher Rate) on your taxable income.

- If you earn more than £150,000 a year, you will pay 45% Income Tax (Additional Rate) on your taxable income.

The wages you earn from your company via its payroll will be added to your rental income to determine your overall Income Tax liability.

If you rent out more than one property and or buy new properties to rent out, HMRC will consider it to be running a property rental business and you’ll need to pay Class 2 National Insurance contributions if your profits are £6,515 a year or more.

When you’re new to renting out property, no matter how much experience you have of running a company, it’s advisable to seek tailored tax advice from an expert. It could really help to maximise your rewards and take away the pain of having to complete tax returns.

Income, Expenses and tax submission all in one.

GoSimpleTax will provide you with tips that could save you money on allowances and expenses you might have missed.

The software submits directly to HMRC and is the solution for the self-employed, sole traders and anyone with income outside of PAYE to file their self-assessment giving hints and tips on savings along the way.

GoSimpleTax does all the calculations for you saving you ££’s on accountancy fees. Available on desktop or mobile application.