How to find your target audience, tribe, niche and communicate powerfully

If you are looking to find your target audience you can get bogged down in too much detail, too many questions and too many possible directions to go in;

- Should you be tweeting?

- Should you be blogging?

- Should you be hosting events?

- Should you be getting in the press, if so which press!

- Should you be networking more (or less!)

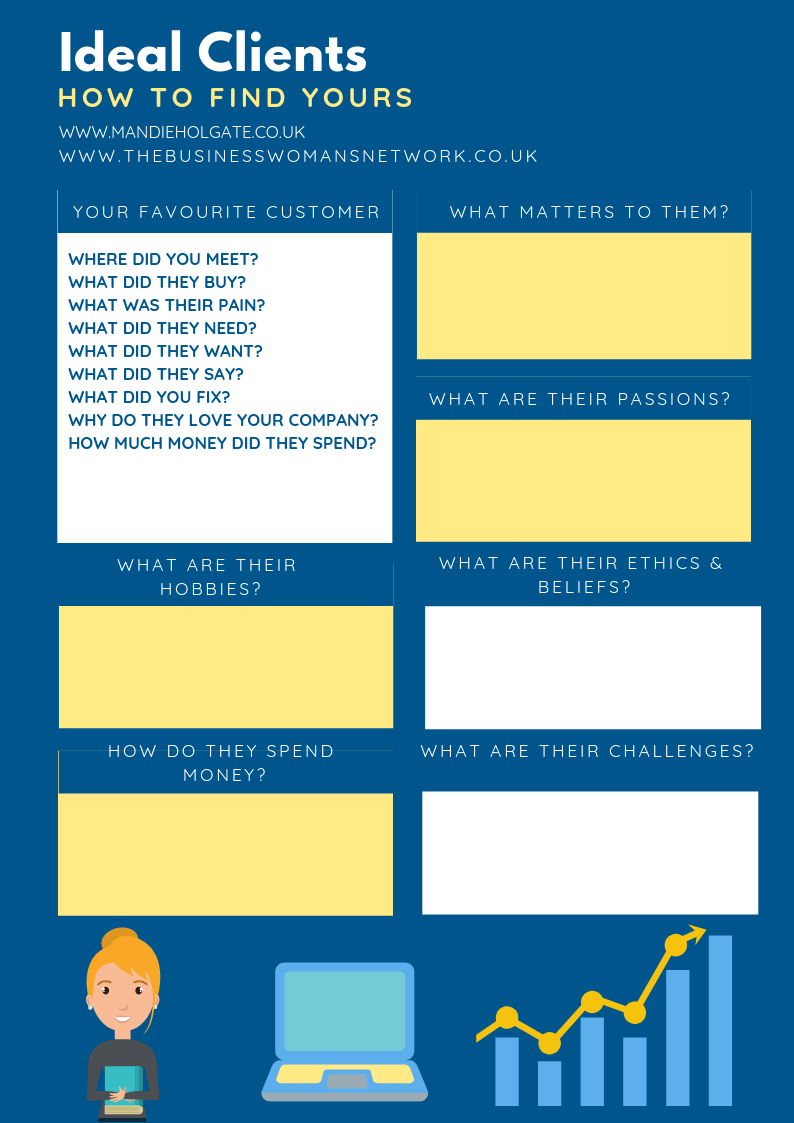

This guide (that you can down load and use again and again) will help you focus your mind. So that whether it’s a new niche, a new product or service or you are just looking to increase profit, secure your section of the market or keep on everyone’s agenda you can focus on what you need to say, to whom, where, and why.

By understanding your favourite clients you can get to really appreciate why people work with you and how to replicate it.

Download your copy here target audience work sheet insiders

And don’t forget to post your completed forms on the INsiders Facebook page and or sections you are struggling with so we can help you get maximum benefit.

If you need more (and who doesn’t?) post to the Insiders for advice and guidance on how to maximise on this quick idea. Or you can get Mandie’s course on Finding your target audiences and getting them to buy here. Don’t forget as an INsider you get 70% off of these courses.

Things I learnt from hosting THAT event;

I thought I’d share with you, the Insiders some things I recently learnt from hosting the free 3 hour coaching session I offered. I hope these things will help you too. This is confidential and not for sharing. I share at a far more honest level here on the Insiders because we’ve grown to know, like and trust one another. and as such hopefully by now you know my tonality and the way I communicate – with love, and passion for your success!

Firstly why the heck did a coach that can easily command £1k for a days training “give it away for a fiver?”

I have had a good year with some amazing clients who have all seen changes and benefits from their time with me and I adore working with these people, so I wanted to give something back. Rightly or wrongly I’m fiercely loyal, care deeply about small business owners and want to be there for those that can’t afford my coaching too, because I know I can make a difference. A bit soppy but yes, I just wanted to be there for you, and I just wanted to show I care and offer something that anyone could access if they were prepared to drop one coffee this week to pay for it.

So what did I learn that could help you for your next “Bums on Seats” adventure;

- This really was a one off. I was inundated with messages saying “I can’t make this one, can you send me details of the next one?” To which the reply was “Sorry no, it’s a one off.” I should have posted that information more because we so often assume that writing something once ensures it’s seen and processed. Posting on the original event page that this is a one off clearly shows that many people just didn’t read the content, so if you are hosting an event, break down the content, ensure it’s got clear headlines for each question that a potential delegate is going to ask. And repeat the key things people ask you in your online promoting.

- You charged £5 for a free event, why? I have never hosted a completely free event because people don’t value their time but they do value money. Worrying isn’t it? Although I should have charged the same as The BWN (£15) I really wanted it just to be a token of “I will ensure I turn up.” Did it work? 50% of the paid tickets turned up. I had 20 booked then 15, then 18, then 13, then 20. (All had paid for their tickets!) How many turned up? 12! So, while I sold all of the available tickets if I had over subscribed I would have filled the room still. See top tip 3.

- Professionalism is worryingly on the decline. Over the past few years of hosting events and being booked to speak, no matter what the company or organisation people are not turning up to things they’ve booked. What’s the big deal right? The big deal is that your name is on a list of attendees and when you don’t turn up people question “where are they?” For me I hear the excuses and yes kids get sick, we get sick, something urgent crops up, and I appreciate that, however if you are not sure you will make it, leave booking until the last minute. If you don’t many people (and I know this to be true because I’m told it often) say things like “If they can’t turn up to this I wonder what it would be like to work with them?” IE “Would that have this attitude to getting my work done or getting my products to me?” Professionalism and credibility is not just built with your products and services and customer service, it is built long before in the way you treat other people. On average you need to expect around 30 to 50% drop off – ie 100 guests, 30 to 50 not turning up – even if they’ve booked! (It never used to be that bad. And probably speaks loudly about time management and core values too.) So this needs to factor into your marketing and available tickets.

- Limited marketing so how did it still fill up? I added this to my Facebook professional page, posted it a couple of times and mentioned this event at 2 BWN events – who I then followed up with the link to book (because while people say they want to book and will, unless they get the reminder they possibly won’t.) If I had to oversubscribe my event (which to be fair I was not that bothered about because it was always going to be about doing the best for those in the room) I would have also;

- Added this to my website on the home page as a neat title and brief sentence with a book here button.

- Wrote a blog highlighting a case study and the damage that overwhelm and lack of confidence does to business success.

- Talked about the courses that looks at confidence and the 6 week course because they cover many elements of what we looked at and others too then ensure I had a sales funnel for delegates and those that were interested but couldn’t not attend.

- Got in the local press – Gazette.

- Sent out the info to all BWN coordinators (and relevant friends) to share at Their BWN events and to “people that could benefit.”

- Added it to all free listing sites local to the venue.

- Posted it in other local networking and women in business pages on social media.

- Set up some automated posts for LI, Twitter and Facebook along with posting to Instagram and Pinterest.

- Listened to the radio so I could phone up and comment on something relevant to mention the course.

- Found a local networking event to speak at to promote.

- Follow up sales. I should have given everyone a nice fancy flyer at the event talking about what we covered, space for them to write their notes (to encourage them to keep my name and number etc) and a call to action about The Insiders and my courses. I didn’t do this because I wanted it to only be about the delegates. And I know respect and “doing what you say you will do” means a lot. And while it won’t get the instant sales, it gets loyalty, builds trust and ensures the conversation flows for another time. Remember you can’t dictate when someone will buy however you can have a say in whom they will choose to buy from.”

- So why won’t you host this again? I won’t be hosting this again because I know my price points for every product and who every product and service is aimed at. And while I absolutely love sessions like this few people would attend if I charged the correct price of £125 without me investing in the marketing to get them there and appreciating the value of the session. (easy to do – just adjust what you say, where you say and how you say it.) and for me it’s easier to get 1 client for 3 hours who drives to my office so that I also save my energy, my time and get to work with one person who is awesome and is highly likely to work with me for a year at least. Okay not the same buzz and fun level of a group session with the clients I love the most, but in business (especially when time and health are factors) you have to consider.

- Follow up communications. If there wasn’t a mountain of work that could rival Everest I’m working on right now, I would also email all attendees and paid guests that didn’t attend to find out what they thought. Those that didn’t attend would tell me why and if there was something I could have done to prevent it and those that did what they loved, hated, want more of and how can help them get what they want. Ideally that’s 28 phone calls to be the most powerful, however you never know they may all get an email at the least.

- It’s all about the in. Events like this are supposed to be lead generators and loss leaders. And as such I should have targeted it to people that are not already actively engaged with me or Insiders to achieve this. (On this occasion this was just about giving something back). However for most business owners an event like this is about lead generation and as such you need to carefully choose and strategise where you promote, how you promote and what people you want to see turn up – ie, “What do we want them to buy after this?” You don’t have to lay on the sales at the event, however you do need to know the sales funnel you are creating here and how you will ensure you achieve it.

I hope these thoughts help you in multiple ways too and I look forward to seeing you in The Insiders, at The BWN and on my courses.

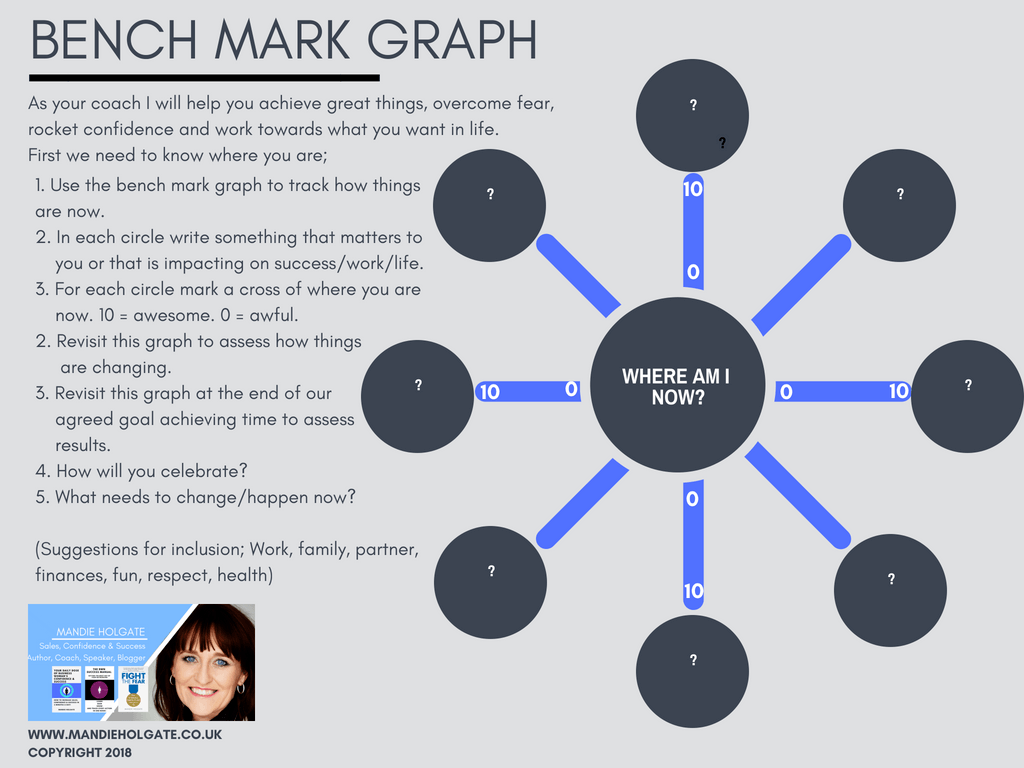

Bench Mark Graph – Mandie Holgate

When I work with a client the first thing I like to do is measure where we are starting from. While I appreciate that clients just want to “get on with it and fix things” as your coach it is imperative to me that we actually know what results we are getting and monitoring what is working, what is not and what needs to change and what needs to be celebrated to keep the results coming.

As a famous professor once said “If you can’t measure it, you can’t fix it” and while I don’t completely agree with this statement if you are spending money on achieving more, overcoming fears and obstacles it is essential that we check you are getting an awesome ROI (Return on your investment).

This tool works easily to help you understand where you are right now. You can use it on one area of your business life, across your company, on your personal life or even your ambitions or bucket list!

Here are some examples of what you could fill your graph with;

Central circle – Am I happy? – (Smaller circles) work, partner, family, home, finance, holidays, hobbies, health

Central circle – Business – (Smaller circles) profit, sales, work/life balance, fun, training, customers,

Central circle – New product – (Smaller circles) Brand awareness, profit, sales, reselling, new customers, data base, interaction.

Benchmark graph worksheet download your copy here – please remember this is for the use of The Insiders only and is not to replicated for anything other than your own personal use. Thank you.

Looking For Creative Inspiration – How To Find It!

I know that for Insiders the issue of coming up with great content and what to write comes up a lot. Have you ever found yourself sat in front of the screen and thought “I’ve got 2 hours to come up with the content here, why can’t I think of anything?”

Or

“I only need to think of the name for this and I can crack on, why won’t my brain work!”

Or

“Aaaaa I haven’t got a single good idea in my head!”

If you have faced any of these scenarios you will know how frustrating it is. You’ve made some space in your mega busy diary to get creative and move your business forward but your brain won’t help and before you know it you’ve commented on someone’s Facebook video of a cute dog and not wrote a single word!

But you know that right? And so you end up getting more and more frustrated, staring at the minutes wasted away and worry some more. So how can you overcome writers’ block and come up with the great ideas?

- Stop panicking and looking at the clock and worrying about how much time you’ve wasted. It makes you worry more. It clags up your busy brain with negative emotions which further shut down your brain to be able to think productively. If you have been at it for more than 10 minutes and achieved nothing, walk away from the location you are in for 10 minutes. Do some filing (you know you never get round to it!) phone that person you were going to just email, check your to do list for the day/week. Get your brain concentrating on something else, and let it do that for at least 10 minutes. Studies show that working on something else creates mental space. Basically your brain is shouting “I know you need the answers, give me 10 minutes and I will keep hunting okay!” Have you ever struggled to remember someone’s name only for it to come to you in the middle of the night or randomly when you are doing something else? Your brain doesn’t stop looking for the answers you want, but it does need the time to process the request.

- Grab a pen and paper (this is ideal for the way it makes your brain work) and list every possible idea you have already come up with. They can be the obvious ones that you have dismissed, the stupid ones, the unrealistic ones, the unaffordable ones. Write them all down. If you have 2 pages of A4 paper filled then you are letting your mind think freely. It’s highly likely the first few that you come up with you will dismiss but the longer you write the more likely you are to come up with content you know your readers will love!

- Don’t dismiss anything, write it all down. And not just ideas. Random words. Random thoughts that you have no idea how it could become an article or a series of posts. Just get it down. We so often dismiss thoughts without fully exploring the answers they are trying to provide.

- Not one for lists? Draw a picture, use a mind map, cut pictures out of a magazine and create a mood board. Allow your creative juices to flow in a way that works for you, but keep it visual. This in itself could make a great article. Remember not all content is the written word, it could be a short video of you sharing how you come up with your ideas and what you will be talking about in the coming months thanks to your mood board.

- Ask others. Friends and relatives are not the best people to ask for ideas from. They love and adore you and have their own agenda and viewpoint already. As I always say your Nan loves you so whatever you come up with she will say “That’s nice darling.” So ask yourself who would be good to ask? Get along to a network like The Business Womans Network. Share your thoughts on social media groups where you feel you will get useful feedback. Ask us, Insiders. Create a focus group – that’s basically a neutral place where you invite some people along to share their views. I tend to give a free half hour session to say thank you, make sure there are goodies in the middle of the room and lots of beverages! Takes up about 2 hours.

- Think of one client. The one that said “xxx” how were they feeling, what were the issues they told you about? How did they find you? What were they scared of? What were they looking forward to? Thinking of one client can create enough ideas for the list in Top tip 2 for months!

- Research online, don’t steal other people’s ideas and creativity, however, it’s a great way to see what other people do and to helps you understand your creative needs.

- What worked in the past? This won’t be the first time you have felt stuck. What helped in the past? How could you recreate that environment to get the results you want?

- CTA. Call to Action. Ask people what do they want you to write about. Make sure they know they can ask you confidentially and you will let them get access to it and that no one will ever know you wrote that just for them.

- Years ago everyone wanted short blogs. Now I’m asked to write longer and longer blogs. In fact the one that had 40,000 views in less than a month was 1800 words! I would still say that at the start if you have no audience keep them short, keep them top tip format, short and snappy and easy to read. As you gain a following them write longer articles and more in depth content.

- Structure – A bit like the essay’s we hated as students! You want to explain what you are going to cover, why you are covering it, what you can expect if you don’t do it and if you do the results you could get. Then layout in easy short paragraphs the top tips and finish with a recap and a this is what you should see conclusion. A call to action like “let me know how you get on” or “what would you like me to cover next?” can get the conversation going. And remember your blogs are there forever, keep it relevant. I get people sending me messages to work with me from blog articles that are 5 years old.

It’s commendable to sit at your desk for hours looking to get your business seen and loved. But with some things in life it’s better to lean on others and find experts to help you get where you want to go. Just because you know what your dentist is doing you wouldn’t start sticking appliances in your mouth and doing it yourself, would you?

Sometimes it’s a good idea to outsource what is really challenging you. If you are finding this is consuming your precious time, it’s time to ask yourself how can I get the results I need faster? But remember even if you outsource it you are still going to have to tell that VA, PR company, copywriter or marketing company the following;

Who am I speaking to?

What do I want them to do?

What results do I want to get?

What do I want them to learn?

What matters to my target audience (s)?

How often do they want to hear from me?

Hope this helps. This is a confidential article for Insiders only. Please do not share this content. However please do share on the Insiders Facebook page how it helps, what you need next and your articles for us to read and review too.

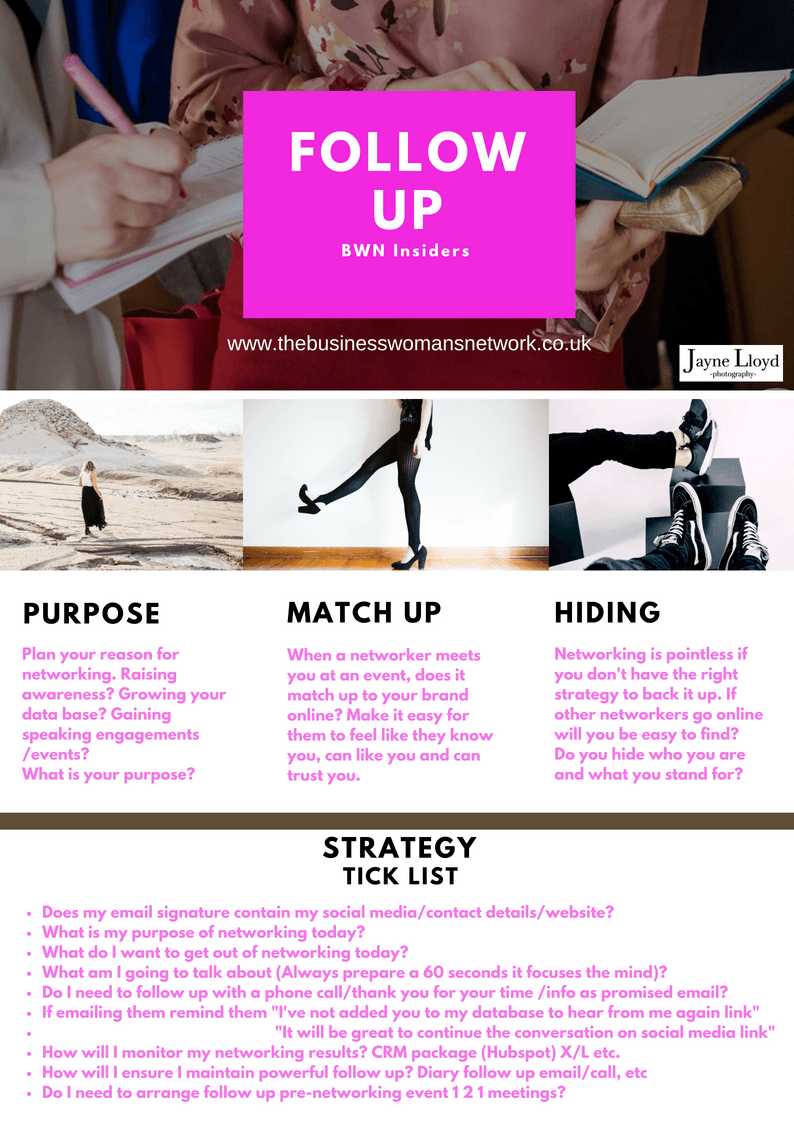

Networking Follow Up Strategy Check List

Of all the things you do for business growth and success, networking is up there with some of the best for real results – ie

- More sales

- Reinforcing your brand

- Learning new skills

- Learning new ideas

- Trialling and researching ideas/products and services

- Repeat business

However, if you don’t’ put in the right strategy and actions then it can be a costly waste of your time. Here is our Insider guide to getting the best out of networking. Remember to cross-reference this with your marketing production line too. You are welcome to download a copy here – The BWN follow up for networking success

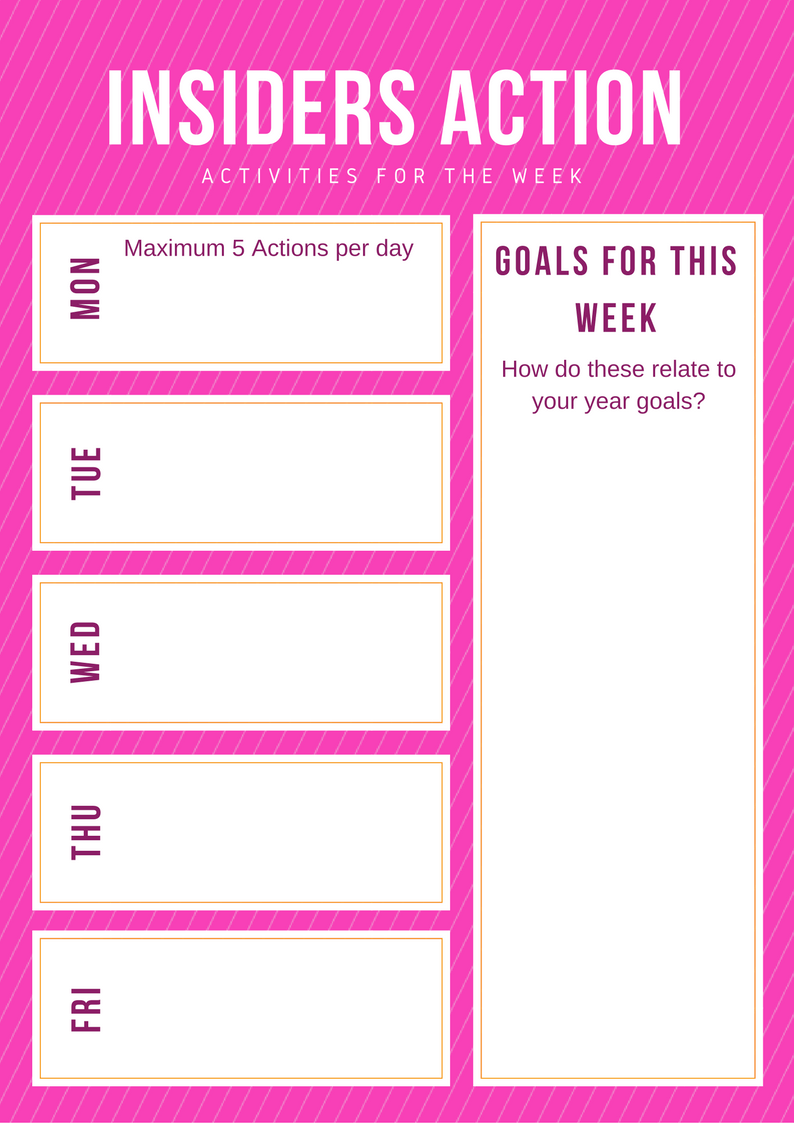

The Insiders Week Planner

You have a busy week ahead how can you ensure you are not just busy but focused, accountable and actually working on the things that will grow your business?

If you want to help create some focus here is our one page INsiders planner for each week.

Don’t add too many tasks or actions to any one day.

Remember to factoring in follow up time after networking events.

Remember you are human and will need to eat, rest and not ignore your loved ones.

Use the Insiders Planner well and you could be ahead by Thursday!

Ensure you keep in mind your longterm goals, and if you don’t know what they are, ask for some help on the INsiders. We are here to help.

Blogging for business – webinar series

Over on the INsiders, we’ve shared a series of webinars looking at blogging for business. And since Mandie decided to be a “blogger” in May and is already a featured blogger for 4 international publications and writing for an additional 7 every month as well as getting shared on LinkedIn by Arianna Huffington and featuring in blogs in other languages too and gained clients as a result of her blogging, we’d say you are in good hands!

Remember blogging for business should deliver engagement in your digital media, new sign-ups to your database and social media accounts, raise your profile as a thought leader in your field, gain you speaking engagements and most importantly of all new leads and new business. So if it’s not working for you, what needs to change? Use these webinars to get your creative juices flowing!

You can access to webinars anytime under the video section of the private and confidential Facebook group, however, is a recap of what was covered. If you need additional advice then tag us in a post or email us. If you take up the challenge and get your blog out there and want to get some advice and support first, you are welcome to share your articles with us anytime.

How to get paid faster

There are many good reasons for getting your customer invoices paid faster, the best of which is to keep your business afloat. There are also lots of good ways to achieve faster payment. Here are my top 7:

1 Credit-check the customer before beginning work. There are many credit reference agencies who will supply a credit report for a fee. Whilst these can be useful, they should not be relied on exclusively. Get market intelligence of the customer, such as speaking to peers, your bank, or trade bodies. If possible, get the customer’s latest data such as its monthly management accounts.

If the customer is found to be a habitual late payer, perhaps with County Court Judgements or worse, then you might prefer to pass on the opportunity, or take greater precautions. These could range from payment on delivery, shorter credit, splitting up your sales, or demanding a deposit.

2 Make terms and conditions of the contract, invoice, and late payment, complete and unambiguous, so there is no room for misunderstanding or dispute by the customer. For example, avoid ambiguous terms such as ‘30d-net’ or ‘payment due on receipt’. State consequences of late payment such as penalty interest, legal action, or cessation of further supplies. State early payment discounts, bank accounts, and acceptable methods of payment such as card, online, or cheque.

3 Invoice the moment you sell a good or service – before the customer (and you) forget. Make invoicing an automatic step at the point of dispatch or completion of a service.

4 Sell your invoice for cash – this is now possible with single invoice finance. It can be quicker and simpler than conventional debt factoring facilities because (if you use Cash for Invoices Limited for example), no security is required, you sell invoices only when you want to, and you pay just one fee. Invoices from as little as £250 can be sold.

5 Build a rapport with the customer. They are more likely to pay you before a faceless business they also owe money to.

6 Have an action plan prepared in case payment is not made on the due date. This broadly will be 1) contact the debtor for an explanation and simultaneously resend the invoice 2) if still unpaid then contact the debtor and state consequences of further delay 3) if still unpaid then take legal steps to collect payment.

7 Whatever the circumstances, always deal professionally and calmly with the customer and an attitude that is realistic, not stubborn. If communication breaks down payment is likely to be delayed further or even withheld entirely. In such circumstances, consider arbitration.

There is no commercial sense in stubbornly pursuing a debtor who is unable to pay in full, when a voluntary agreement to pay over a longer period would recover at least some of the amount owed and would avoid costly debt collection and legal fees.

Dr P Singh is director at single invoice finance provider Cash for Invoices Limited and an Affiliate of the Business Woman’s Network which means you can work with Cash for Invoices and get a discount.

Sources

Forbes;Business.com; Sage; Entrepreneur.com; Xero.com; Huffington Post

There are many good reasons for getting your customer invoices paid faster, the best of which is to keep your business afloat. There are also lots of good ways to achieve faster payment. Here are my top 7:

1 Credit-check the customer before beginning work. There are many credit reference agencies who will supply a credit report for a fee. Whilst these can be useful, they should not be relied on exclusively. Get market intelligence of the customer, such as speaking to peers, your bank, or trade bodies. If possible, get the customer’s latest data such as the its monthly management accounts.

If the customer is found to be a habitual late payer, perhaps with County Court Judgements or worse, then you might prefer to pass on the opportunity, or take greater precautions. These could range from payment on delivery, shorter credit, splitting up your sales, or demanding a deposit.

2 Make terms and conditions of the contract, invoice, and late payment, complete and unambiguous, so there is no room for misunderstanding or dispute by the customer. For example, avoid ambiguous terms such as ‘30d-net’ or ‘payment due on receipt’. State consequences of late payment such as penalty interest, legal action, or cessation of further supplies. State early payment discounts, bank accounts, and acceptable methods of payment such as card, online, or cheque.

3 Invoice the moment you sell a good or service – before the customer (and you) forget. Make invoicing an automatic step at the point of dispatch or completion of a service.

4 Sell your invoice for cash – this is now possible with single invoice finance. It can be quicker and simpler than conventional debt factoring facilities because (if you use Cash for Invoices Limited), no security is required, you sell invoices only when you want to, and you pay just one fee. Invoices from as little as £250 can be sold.

5 Build a rapport with the customer. They are more likely to pay you before a faceless business they also owe money to.

6 Have an action plan prepared in case payment is not made on the due date. This broadly will be 1) contact the debtor for an explanation and simultaneously resend the invoice 2) if still unpaid then contact the debtor and state consequences of further delay 3) if still unpaid then take legal steps to collect payment.

7 Whatever the circumstances, always deal professionally and calmly with the customer, and an attitude that is realistic not stubborn. If communication breaks down payment is likely to be delayed further or even withheld entirely. In such circumstances, consider arbitration.

There is no commercial sense in stubbornly pursuing a debtor who is unable to pay in full, when a voluntary agreement to pay over a longer period would recover at least some of the amount owed, and would avoid costly debt collection and legal fees.

Dr P Singh is director at single invoice finance provider Cash for Invoices Limited and an Affiliate of the Business Woman’s Network

Sources

Forbes;Business.com; Sage; Entrepreneur.com; Xero.com; Huffington Post

How do I get my blog out of Never Read Land?

You’ve written your first blog and now you need to work out how to get it read. Here are some ideas to help you do just that. And bear in mind I actually feel very confident to say that I know what I’m talking about here. It’s led to me being asked to write a book for the UK’s leading non-fiction publisher, being asked to be a featured blogger for 2 international publications and lots of clients for my coaching, courses and books. So I know this works, you just have to actually do what I suggest.

So how do you ensure that people actually find your blog?

Firstly ideally it will be on your website for a variety of reasons but the most obvious one is that it brings new fresh relevant information to your website – and trust me that’s good for your SEO and ranking.

If you can’t get it on your website relying on WordPress or Blogger, etc is better than not having one. And they are free and pretty easy to set up and use.

LinkedIn also has a useful feature that enables you to blog within your profile. Even if you feel your business is business to consumer and not to the business owner or professional remember a well-worded article will get read by professionals. They still have lives outside of business that could need what you offer!

So you have an interesting relevant useful blog now its time to get it seen;

Talk about it on social media – Youtube, Linkedin, Facebook Instagram and Twitter are the main ones. But don’t just do endless links to your blog – you have to build up interest and get to know people first. If anyone in their very first tweet to me says “Hey check out my website, blog, FB page- I’m instantly turned off. They have never met me and they are already assuming that I need what they have. If they took the time to build a relationship with me I would be more than happy to “check out their blog” etc. So build relationships first and you do that exactly the same way as you would face to face;

Be interested in others, share useful tit bits (this works really well, commenting on other peoples discussions on Linkedin etc (so ensure you join the right groups too) allows you to get to know other people’s opinions and then share yours. If you have had a great conversation with someone then you can say “Funny enough I wrote this about this very subject…” but only after being interested, considerate and getting to know others.

If you have a mailing list (Please tell me you have one of those!) whatever effective ways you have to stay in touch with your client base (Please tell me you are doing that!) share your blog ideas there too. Don’t share the whole thing, just put something like “A client had the issue ………. so I shared this great solution and so I thought I would share it with you too. To read more…….”

Remember in this fast paced world everyone wants instant answers so sharing little useful titbits makes you a very useful golden nugget to keep in touch with – what’s that going to do to your sales and business growth?

If you publicly speak (and where ever you go NEVER turn down the opportunity, you never know who is in the audience and who they know!) finish with something like “There are a ton of free ideas on …………on my blog, so help yourself.”

Tell people about it in every form of your marketing in a useful relevant informative way ALL OF THE TIME. People make the mistake of assuming you can tell someone once on Twitter and that will get you a thousand hits – it won’t! You need to be consistent.

You have to tell people over and over again in a useful, relevant informative way (Hope I’m getting that across – ha ha!) in short succinct chunks. It’s the drip drip drip approach. That if you keep telling people they will get the message and want to know more and keep in touch and what does that do for your business success? Thus you always need to consider what is it that you want to be known for? Keep this at the forefront of your mind when writing to ensure you stay bang on subject.

These ideas will work, I have a ton more to share but get this right for starters, be consistent and you will see positive results and a great impact on your business.

I will also share a webinar on this subject of what to write, how to write it and how to get it seen on The Insiders too. If you have personalised questions you wish to ask, just say.

Why invoices are not paid to SMEs

Here Dr P Singh from Cash for Invoices shares research and answers to why they say your invoices don’t get paid.

Several reasons have been revealed for invoices not being paid to SMES, but single invoice finance from Cash for Invoices Limited can provide essential cash, says Dr P Singh.

Research cited in CityAM showed an alarming state of affairs in recovering money owed to small businesses by debtors.

The research revealed several reasons cited by small businesses as to why they wrote off billions of pounds collectively owed by debtors. Top of the list was insolvency of the debtor, followed by doubt that the debtor had funds to pay.

Equal 3, 4, and 5th place reasons cited were lack of time to chase, risk of damaging the relationship, and no funds to pursue the debtor.

These are all concerning reasons for SMEs writing off collectively £6 billion of debts in 2015/16 according to Direct Line. The average write off was over £31,000 and a staggering 10% of companies each wrote off over £100,000 owed by bad debtors.

These alarming losses might have meant the company had a shortage of cash flow needed for running its business, such as: paying overheads, managing working capital, growth, or research and development. The shortages might have been made up by urgent loans but that solution will have led to further costs (of interest) and reduced bank funding capacity.

Cash for Invoices Limited in London buys single invoices for cash. It will pay up to 97.5% of the invoice amount less a 10% retention that is handed to the company provided its debtor pays the invoice. The fee is therefore just £2.50 per £100 of invoice for a 30-day invoice. A small price to pay to get cash into the business. If the debtor were to default then Cash for Invoices Limited will not sell the invoice back.

Unlike many bank and other factoring companies, a multitude of fees are not charged to benefit from Cash for Invoices Limited single invoice service. No arrangement fee for example and no service charges, exit charges. Nor are there annual renewal charges because no facility is set up with the selling company. There is no commitment for the small business to sell any invoices to Cash for Invoices Limited.

A significant advantage of the single invoice finance service from Cash for Invoices Limited is that it requires no security off the selling company: no debenture, no personal guarantees, or other charges. That is a substantial improvement over many bank and other factoring companies’ factoring facilities.

If a small business answers yes to either of the following questions, then it would benefit from Cash for Invoices Limited’s single invoice finance service:

1 Do you occasionally need more time to pay your supplier invoices?

2 Would you like invoices you send to customers to be paid sooner?

Cash for Invoices Limited’s single invoice finance service outperforms conventional factoring because:

a) it does not require security from the selling business (such as a debenture or guarantee)

b) just one invoice can be sold

c) there is no commitment to sell any invoices to Cash for Invoices Limited, and certainly not the business’s whole sales ledger

d) very small value invoices (from £250) may be sold, ideal for micro-businesses

e) one fee only is charged, plus a refundable retention. Unlike similar service providers, Cash for Invoices Limited does not charge: arrangement, servicing, renewal, or exit fees. The current fee is just 2.5% of the invoice. The refundable retention is 10% of the invoice. This is paid to the business if its debtor pays Cash for Invoices Limited in full and on time.

f) For supplier invoices, the payment date of the supplier’s invoice bought by Cash for Invoices might be extended, giving the business up to 60 days extra time to pay Cash for Invoices Limited.

To get a free no-obligation quote on how much cash you could receive from selling just one invoice, contact Cash for Invoices Limited or call 0208 987 0429