How To Get Ready For The New Tax Year

The UK tax year starts on 6th April and runs to 5th April the following year. It’s the perfect opportunity to reflect on the previous tax year, wise up on any new legislation that might affect your tax return, and look for opportunities to simplify the process and even reduce your tax bill where possible.

Not sure where to start? Not a problem. We’ve asked Mike Parkes from GoSimpleTax to give his best tips on preparing for a new tax year.

Digitalise the tax return process

If you’re still working with paper, let 2021/22 be the tax year you move online. After all, paper tax returns need to be filed three months before the online one, and they’ll be phased out in a few years as part of Making Tax Digital (MTD) anyway. So, why not make the change now?

MTD is an initiative launched by HMRC to make it easier for the self-employed to keep on top of their tax affairs. From April 2023, they want all sole traders to submit their self-employed income and expenses online and on a quarterly basis.

What’s more, moving online can often remove some of the time, stress and mistakes that usually come with a paper tax return. There’s even dedicated tax return software, like GoSimpleTax, that’s designed to make it much easier to log income and expenditure throughout the year, and then submit this information straight to HMRC.

Record income through invoicing software

Once you’ve moved your tax return online, whether that’s through software or HMRC’s Government Gateway, start requesting payment digitally with invoicing technology.

Invoicing tech formalises your payment process. Instead of sending over Word or Excel invoices, this software can send fully branded requests to your clients. They can also integrate with things like your Gmail account or your preferred payment solution, such as PayPal or SumUp.

Plan ahead to reduce your tax bill

The moment that the new tax year starts, you’re free to file last year’s tax return. My advice is not to wait, as tempting as it might be! This is the point where all your income and expenditure is fresh in your mind, so it’s far easier to collect up all the evidence and use it to submit an accurate tax return.

Filing a tax return early doesn’t mean you’ll have to pay your tax bill early, remember. It just means that you’ll get your bill almost a year in advance of its due date so that you can better manage your cash flow.

Even starting to complete one early has its benefits. It gives you time to review your expenses and find opportunities to make tax savings. You can save a fortune by identifying purchases that are classed as allowable expenditure, so why not give yourself time to check?

If you take these three key steps, you’ll be in a great position to file your tax return as soon as the new tax year starts – and then you can get back to doing what you do best.

About GoSimpleTax

GoSimpleTax software submits directly to HMRC and is the solution for self-employed sole traders and anyone with income outside of PAYE to log all their income and expenses. The software will provide you with hints and tips that could save you money on allowances and expenses you may have missed.

Try for free – add up to five income and expense transactions per month and see your tax liability in real time at no cost to you. Pay only when you are ready to submit or use other key features such as receipt uploading.

PDA members receive a 30% discount off GoSimpleTax.

The budget 2021 – self-employed what does it mean for you?

Chancellor Rishi Sunak yesterday unveiled the nations finance plan in the Budget 2021. GoSimpleTax take a look at what this means for the self-employed.

Key announcements

- Two further SEISS grants will be paid to the self-employed in 2021;

- 600,000 of the newly self-employed will become eligible for the SEISS grants;

- The furlough scheme is to be extended until the end of September; employers will have to contribute 10% in July and 20% in August and September;

- The £20 uplift in Universal Credit will be extended for another six months;

- VAT for hospitality firms will remain at 5% until September, followed by an interim rate of 12.5% for six months;

- The business rates holiday has been extended until June and business rates will then be discounted for nine months;

- Non-essential retail businesses are to get re-opening grants of up to £6,000 per premises;

- Hospitality and leisure businesses (that are set to open later) will be eligible for grants worth up to £18,000.

Mike Parkes, a Director at GoSimpleTax had this to say.

‘As expected, SEISS grant four was confirmed, topped up by SEISS grant five that will run until September 2021. To apply the self-employed must have filed their 2019/20 no later than the 2 March 2021. Whilst there are no increases to income tax rates, from April 2022 the personal tax allowances and bands will be frozen until 2026.’

SEISS fourth and fifth grant

‘At the Budget it was confirmed that the fourth SEISS grant will be set at 80% of 3 months’ average trading profits, paid out in a single instalment, capped at £7,500. The fourth grant will take into account 2019 to 2020 tax returns and will be open to those who became self-employed in tax year 2019 to 2020. The rest of the eligibility criteria remain unchanged.’ HMRC continue to say,

‘Your eligibility for the scheme will now be based on your submitted 2019 to 2020 tax return. This may also affect the amount of the fourth grant which could be higher or lower than previous grants you may have received.’ You can read more on the fourth and fifth grant here via .Gov

About GoSimpleTax

GoSimpleTax software submits directly to HMRC and is the solution for self-employed sole traders and anyone with income outside of PAYE to log all their income and expenses. The software will provide you with hints and tips that could save you money on allowances and expenses you may have missed.

Try for free – add up to five income and expense transactions per month and see your tax liability in real time at no cost to you. Pay only when you are ready to submit or use other key features such as receipt uploading.

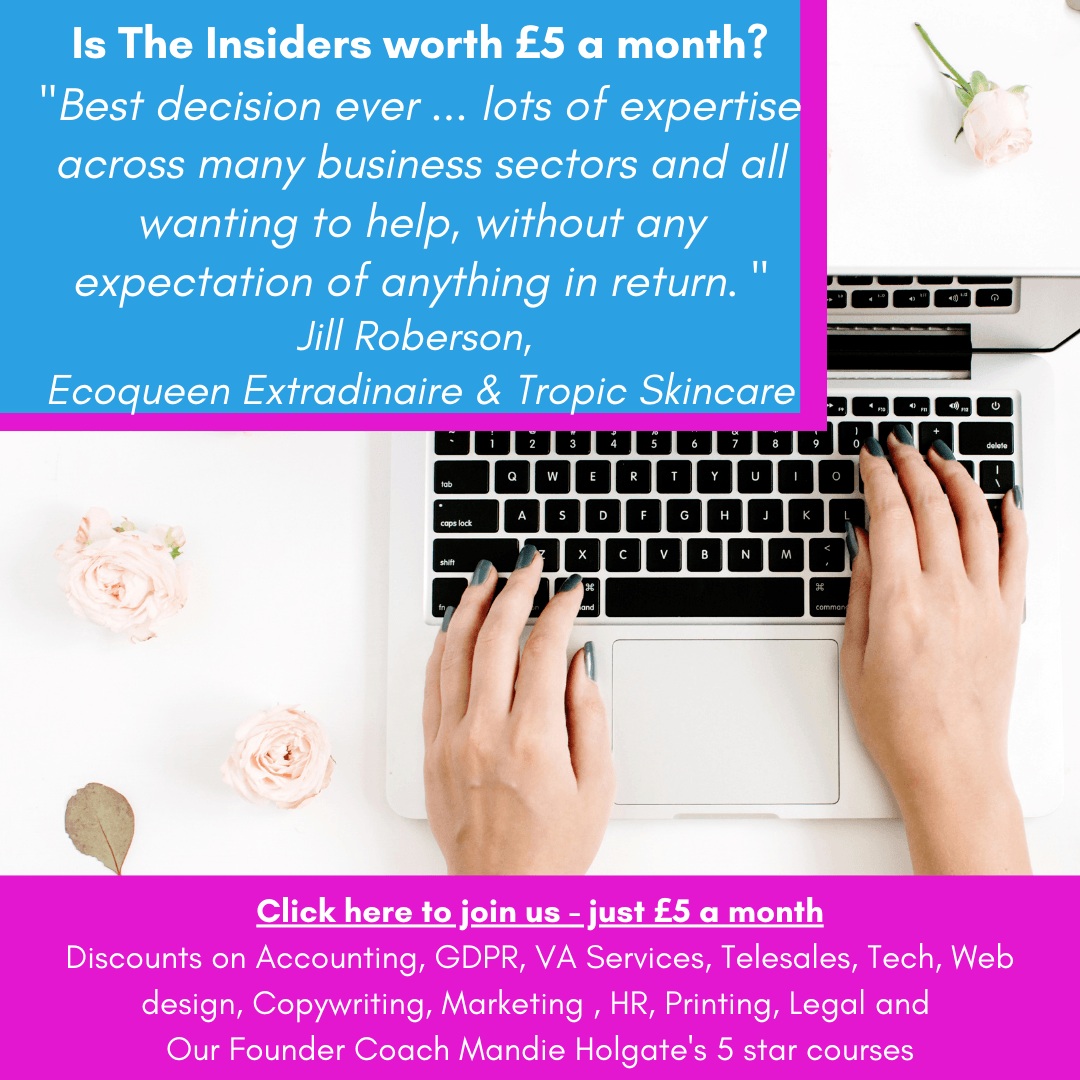

Can £5 a month really make your business better?

We’re incredibly proud of our mastermind group for anyone looking to further their career, grow and sustain a business or charity but it’s even better when one of the confidential business men and women come forward with such inspiring positivity about the results our business and personal and professional development mastermind group can help you achieve.

Meet Jill Roberson who like many has had an incredible career that has not been without its hardships and horrors. A Tropic Ambassador, working on the front line against Covid (Thank you Jill) and a passion for the planet and the environment that makes her an Eco Queen who is turning that passion into a thriving business now looking for more affiliates to work with who appreciate that going green is good for business as well as the planet. With a new eco challenge for families and businesses recently launching Jill is doing great things. And here Jill shares how the Insiders is helping her achieve that.

1. Why did you join the Insiders?

When I used to run my own biz (over 10 years ago) I used to attend the local physical BWN network – always great value, interesting speakers and other attendees. Until about a year ago I had been back in employment and kept in touch with the network. Then I was made redundant just prior to the first lockdown. I was also running a small biz on the side and took this as an opportunity to develop that and to develop myself, so got back in touch and committed to the grand sum of £5 a month to be part of the BWN Insiders group.

2. How has the Insiders helped you?

Best decision ever … lots of expertise across many business sectors and all wanting to help, without any expectation of anything in return. It is so important to get independent, constructive feedback on your ideas, application methods etc. We get so wrapped up as to what is important within our business, that sometimes we forget about our target audience and whether it is all of utmost important to them. The Insiders gives you a great platform for bouncing around all sorts of ideas.

3. What successes has the Insiders helped you achieve?

So the Insiders has given me the confidence to become a monthly contributor to an independent local magazine as an ‘expert’ having built my personal brand through various methods discussed in the group. I am running a month long targeted social media Eco Booster Programme, that has the potential to be developed into an online course. I’m also developing a business equivalent, together with a paid-for (heaven forbid money!) eco advisory service.

4. What process would you say this took you through?

The group have enabled me to explore lots of different ideas/options without any fear of being judged, they’ve contributed ideas and as I’ve come back with variations/adaptations and tweaked versions, they’ve all been encouraged.

5. What have you learnt about being a successful business woman?

The group, through their generosity, have enabled me to respond to others in the same way, develop some great connections and teach me that I am good enough and that if I need a hand, someone will be there to help. It’s also taught me to accept the good with the bad and to rest when I need to – I don’t need to be a Super Woman to get stuff done.

6. What would you share with other business owners about this experience?

Over and above all of the above, and expertise and encouragement that Mandie gives is absolute gold dust. When I used to attend the physical networks, and encourage others to join, I would say that no-one is as enthusiastic about your business as yourself … and Mandie Holgate.

Jill wouldn’t promote her article, so we will – Congratulations Jill. You can read it here in Icen

Join the Insiders here – we would love to welcome you.

And learn more about Mandie Holgate here – her courses are very popular with the Insiders and Insiders get a 70% discount on all her courses. Yes really, 70%