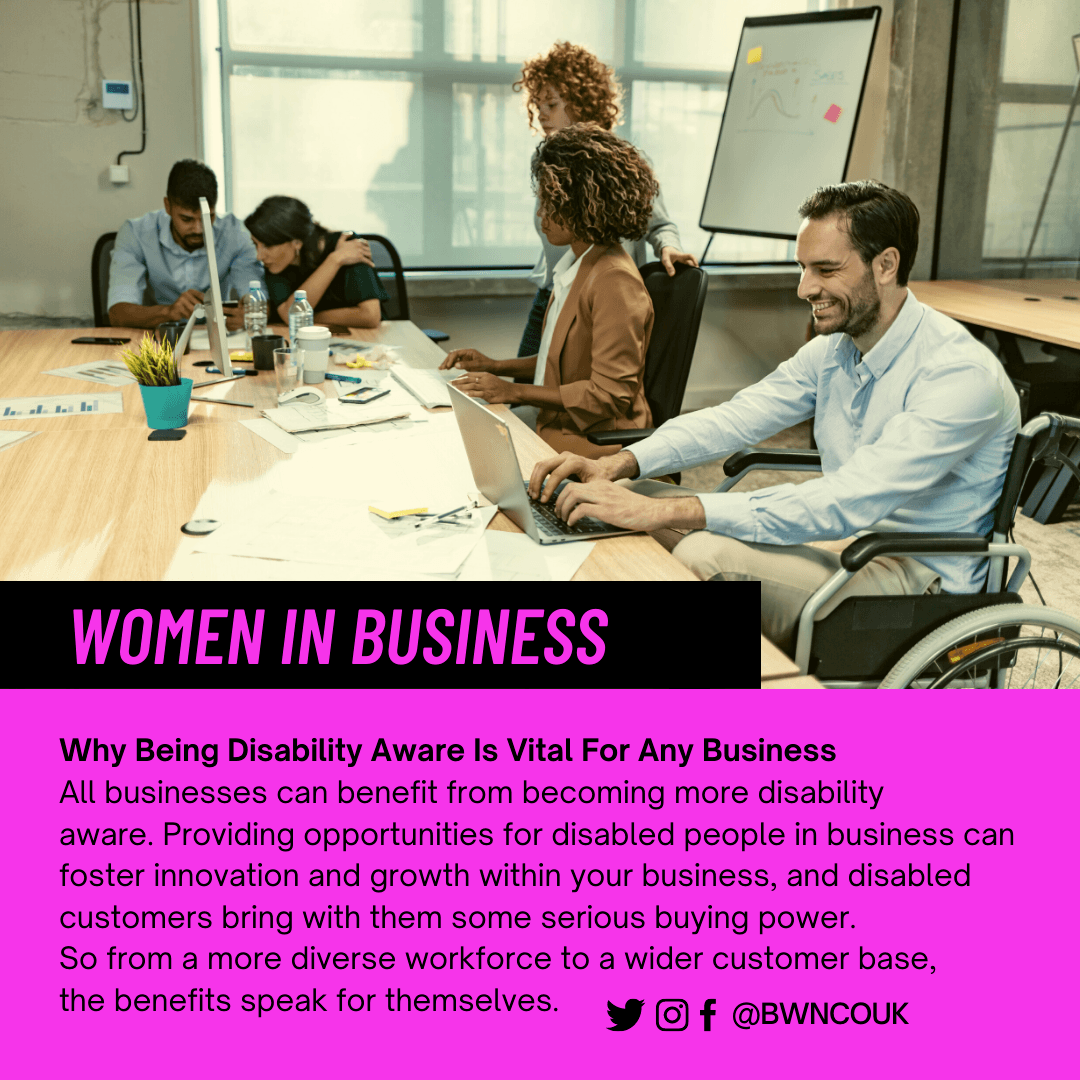

Why Being Disability Aware Is Vital For Any Business

All businesses can benefit from becoming more disability aware. Providing opportunities for disabled people in business can foster innovation and growth within your business, and disabled customers bring with them some serious buying power.

So from a more diverse workforce to a wider customer base, the benefits speak for themselves.

The Purple Pound

With more than 7 million adults in the UK living with a disability, many businesses are missing out on the power of what’s known as the purple pound – that is, the buying power of the disabled population.

The spending power of the purple pound is estimated at around £2.74 billion – and many businesses are missing out on this entirely due to a lack of accessibility.

Making your shop or website accessible can open your business up to a huge pool of new customers. Many businesses have started to do this with innovations like autism-friendly hours at supermarkets, where lights and music are dimmed to allow for a more calming peaceful shopping experience. Adapting your business with measures like wheelchair-friendly ramps, text to speech functions on websites, and Braille signage can really improve the experience of a disabled customer.

There are countless other ways you can adapt your business to help disabled people, and many are not going to require a huge budget – and for those that are, there are many government grants available to businesses who wish to make their accessibility truly top notch.

Casting A Wider Net For Talent

It goes without saying that the wider pool of candidates for a job within your business you have, the more chance you have of ensuring that you find the best person for the job.

Making sure that your business is disability friendly is key to accessing that wider pool of jobseekers. Knowing that you have the accessibility for any potential disabled employee will mean that nothing is standing in the way of you giving the job to the most qualified person.

There is plenty of help out there for businesses wanting to improve their places of work to make them accessible to everyone. There are also plenty of resources out there to help you connect with disabled candidates like Careers With Disabilities. They also have great information on the benefits and funding available for businesses wanting to support disabled workers.

Tackling Double Discrimination

As women in business, we have all struggled with discrimination of some form over the years. This impact is felt even harder by women with disabilities. This has been described as the double discrimination gap.

The intersection between gender and disability discrimination is particularly felt among disabled women. They are more likely to be marginalised than their male counterparts, particularly economically. There has been a movement to change this economic gap but businesses need to do their part to bring about change.

It is well known that businesses with more women thrive with much better innovation, problem-solving, and inclusivity. Making your business accessible to disabled women can make a huge difference in the fight to make the world a fairer place for all.

Do I Need To Complete The Self Assessment? How To Know If You Have A Tax Return Due

If you are classed as self-employed or have a source of untaxed income, you will be required to complete a Self Assessment. However, this criteria is vague and many are left confused as to whether they actually need to file the tax return or not.

GoSimpleTax’s Technical Director Mike Parkes provides clarity on the process…

Main types of self-employment

Typically, being self-employed relates to those who are a sole trader, part of a business partnership or director of a limited company. The latter two will definitely require a tax return to be completed.

If you’re a contractor using an umbrella company, it might not be necessary to file a Self Assessment as they are technically your employer. Those who are employed and undertake freelance work as an additional source of income are still classed as self-employed and will need to file a tax return.

Selling online

Those who carry out self-employed work as a sole trader will only need to submit the tax return if they earn more than £1,000. The same applies to those online sellers whose sales total exceeds this amount.

Even if you’re selling some possessions to earn extra cash, rather than build an online empire, you may be required to complete a Self Assessment and pay any tax owed on the income. There may even be Capital Gains Tax due if an item is not a car.

Renting out property

If you’re a landlord earning £2,500 to £9,999 (after allowable expenses have been deducted), you’ll be required to file a tax return. This requirement also takes other factors into account, such as additional income from employment or a pension. Potentially, small rental profits can avoid the Self Assessment and be handled by HMRC if they approve a request to adjust your PAYE code.

To work out your taxable rental profits, you first need to determine the type of renting. Rules differ for each situation: renting a room within your main property, letting a furnished holiday letting, and renting out foreign property or one in the UK whilst you live overseas.

INsiders receive a 10% discount off GoSimpleTax – Get started today and your discount code will be emailed to you.

Being a Minister of Religion

Even though Ministers of Religion are technically employed and paid via the payroll of the Church, they are required to submit a tax return. On top of this, there is an additional form (SA102M) specific to this role which will need to be filled out.

The Church will supply you with a P11D form at the close of every year – this details the taxable benefits and reimbursed expenses you’ve received. Those expenses paid for by the Church can’t be claimed on, but any paid by you have the potential to be offset.

Other circumstances

There are a few other situations that would require the submission of a tax return. These include income from savings and investment or if you earn foreign income.

Foreign income may also require you to complete the supplementary SA109 pages. There is specific criteria around this – you would be taxable on a remittance basis. You will also be taxable if you’re classed as a non-UK resident, not usually a UK resident, or have dual residence.

Other businesses are permitted to stay open – this includes those providing essential goods or services, including: food shops, supermarkets, garden centres and certain other retailers providing essential goods and services. Essential retail should follow COVID-secure guidelines to protect customers, visitors and workers.

About GoSimpleTax

GoSimpleTax software submits directly to HMRC and is the solution for self-employed sole traders and anyone with income outside of PAYE to log all their income and expenses. The software will provide you with hints and tips that could save you money on allowances and expenses you may have missed.

Trial the software today for free – add up to five income and expense transactions per month and see your tax liability in real time at no cost to you. Pay only when you are ready to submit or use other key features such as receipt uploading.

It’s not just business owners that love us…

How awesome is it that international speakers and business experts offer to speak at our events!

These are some of the best speakers globally for business and personal and professional development. We recently had a call from Colin McLean a specialist in presentation skills. He won’t tell us which TV celebs he’s worked with!

Colin has hosted the business masterclass at a BWN event 5 times over the last 11 years! AND is coming back to the Insiders this October to deliver something very exclusive! You can’t get this unless you pay to work with Colin!

All of our webinars for the Insiders are accessible forever to our mastermind group so grab a coffee because there is some awesome ideas in there for you to grow your business, increase sales and profit, communicate powerfully even how to deliver a winning 60 seconds.

Here Colin has kindly delivered a copy of his new article on

After you get up in the morning, how long is it before you look at a screen?

There’s no right or wrong answer but the question serves to emphasise that, like it or not, our lives are dominated by screen time of one sort or another. Our phone, our tablet, our TV, our laptop or monitor; in our car, in city centres, at the surgery, the bus stop .. the list is endless.

Nothing new there, you say. Well, no. Except for so much of our time we have been the active ones, our screens have, by and large, been passive. We have absorbed information, entertainment, instruction, messages from our screens. That, of course, continues.

What has changed is that now our screens are active participants too. Forced into the world of Online Comms – whether that be on Zoom, BlueJeans, Skype or a dozen other similar platforms – we are needing to acknowledge different rules.

Ok, it’s the camera that’s active, I accept, but on many devices the camera is as good as unseen.

Even perched atop your monitor it’s all but invisible.

So here’s my point: these days you’re not just ‘watching TV’ you are on it. You are, thanks to so much ‘zooming’, a large part of everyone else’s screen-time. You’re on show and so is everything about your home or office set up.

We need to think about our screens as no longer opaque; the screen lets us look out, but crucially others look in.

In this changed world we need to rethink our role. And I believe we need to set ourselves a few standards and stick to them.

For a start, let’s ensure that what others see is, as far as any of it is in our control, what we’d like them to see. At least let it complement us and our message, not(unintentionally) sabotage it. There’s often a lot we can do to improve things,visually for starters, that are painlessly simple.

Other crucial matters – audio for example – might require more thought.

Let us review our individual set up to make it easy and welcoming on the incoming eye. But let us go further. Let us resolve to be sensitive during our online meetings, to remember the power of focus, of eye contact and of smiles and nods. Non-verbal communication hasn’t gone away; in many ways it’s all we’ve got, particularly as attendees.

Let us resolve, too, to leave checking our emails, or the dozen other diversions that crave our attention. Our focus, for the duration, must be on each other, and nowhere else.

Ask any speaker (from the world BC*) and they will confirm that the principal gain, and the rocket fuel that keeps them going, is the energy shared and returned by their audience. That ‘virtuous circle’ of shared energy can be a real high. Replicating that online is unquestionably harder, but there are ways and there still can be rich rewards.

But let us start by turning up to our own TV show with some pride and purpose.

*Before Covid”

Thanks for sharing Colin. You can catch Colin’s new webinar on the Insiders this October. To join us click here.

More event details here

The Screen Bites back – Life in the Zoom era

Colin McLean of Presentation Works

(www.presw.com)

Why I’ve networked with the BWN for 10 years…

Sarah Travers from Ajax Wealth Management was the second person to buy a 2021 Golden Ticket for our networking and business growth events. As we sent the invoice we noticed that Sarah has been networking with us since 2010!

We asked Sarah why she networked with us so much and this is the reply Sarah sent us.

“I have had the pleasure of being involved with the Business Woman’s Network for 10 years. Wow! That time has flown by and I have enjoyed every minute of it. Read on to find out why I still network with the BWN after all these years.

Support

One of the most important aspects for me is that the business women (and men) who regularly attend the BWN are incredibly supportive of each other. Whether that is helping with ideas, connecting with others, or simply just being a sounding board, the members are genuinely interested in each other’s businesses and want to help them thrive. Who wouldn’t want to meet people like that?

Mandie Holgate, who founded the BWN, also cannot do more to promote and support the BWN members. She has a passion for helping businesses to succeed and her energy and enthusiasm brings a real buzz to the meetings.

Education

As I am constantly telling my children, we never stop learning and the BWN meetings have excellent guest speakers covering a variety of subjects aimed to support people in business. I cannot think of a meeting where I have not learned something and always feel it is time well spent.

The confidential Insider group on Facebook is also a great place to ask questions, find resources, learn and grow without any selling at other members.

Fun and Friendship

Over the years I have got to know many lovely people that I have met through the BWN and consider them to be friends as well as business associates. Although the meetings are for serious business, they also have a generous helping of fun; one of the most memorable for me being a visit from Mary Poppins (aka Nicola Goodchild) who had us all feeling like slightly naughty, giggly children. Laughter really is the best medicine, even for serious business owners!

Networking That Works

When I first started networking, I would dip in and out, attend a meeting here and there then get too busy to attend. That doesn’t work. I am now a Golden Ticket holder for the Colchester events and make sure I attend every month. It takes time to build relationships and trust, that can only be achieved by being consistent, being yourself and being reliable.

Golden Ticket holders can also write for the BWN blog and attend other BWN meetings for a minimal fee. With the meetings being held virtually at present location is not important and I am getting to meet even more fantastic business owners.

If you haven’t tried networking, or have tried in the past but didn’t get anything from it, I wholeheartedly recommend you give the BWN a go, I’m sure you won’t regret it.

Sarah Travers, Independent Financial Adviser, Ajax Wealth Management

To learn more about our Golden Ticket click here

To join us on the confidential mastermind group click here.

Our events are virtual and are the 1st Wed, 2nd Thurs, 3rd Fri and 4th Thurs of every month. We also have exclusive events for our mastermind group – The Insiders that you can watch again whenever you like from top international speakers and business experts.

And Sarah’s investment with us this year has been £190!

Networking No No’s, Jugulars and Obiters

Here our Founder Coach, Speaker and Author Mandie Holgate shares some top tips to get the most out of networking.

“When it comes to networking I’m often asked for help because business owners find themselves spending time and money on networking and yet not getting the results they want.

Personally I find this difficult to get my head around because I rarely come away from a networking event without a new client, lead or business opportunity. But then I do understand the obstacles that stop successful networking and the good news, its pretty easy to fix.

So what are the key skills that lead to networking success?

What habits should you avoid like the plague?

And how can you make networking a powerful tool for business growth?

The first thing I usually say to anyone looking to improve their networking is what do you want from networking?

Too many people think they can walk into that virtual room once and get a new client. The fact is networking is a slow burner, but there are some powerful ways to make it a powerful burner. So for starters if you are going to a networking event, find the event on social media and let everyone know you will attending. A word of warning here this is not your carte blanche opportunity to share links to your website and social media and expect everyone to be wanting to buy from you instantly.

You wouldn’t walk up to a stranger and try to sell them something like a door to door sales man so don’t make the assumption that a networking event allows you to do this.

Networking is always, has always and will always be about building good relationships. And the key to good relationships is consideration and respect. Get interested in other people and be on their agenda. But lets flip this around for a moment and although you are on their agenda you must know prior to the event what your end goal is.

So what is the end goal of networking for your business?

How many networking events will you commit to attend every month? And a top tip here commit to get to the same network a good few times before you decide if its right for you. Try different events at different times of the day to get to meet a diverse range of business. The great news about our events is because they have no membership you are always going to meet someone new. And that’s a great opportunity for your business!

What is your goal at each event?

Is it to speak to 5 business owners. Don’t aim to spam everyone with your business links and special offers.

You must have seen what I call the Jugulars. They sweep into your conversation, manipulate it around to what they do. And then once they know everyone has got what they do, seen a link, they excuse themselves and move on to the next victim…er sorry business owner. In my experience they never send you a nice email saying thanks for your time and it was great to meet you but make the assumption you’d love to be on their mailing list. There folks in that sentence are a good few tips on how not to network and make enemies.

Remember that nice people have a habit of making sales. Why? Because they are genuinely interested in other people and do that really powerful thing called listening. If you really want to power up your results in networking (and marketing and closing the sale!) then listen. Give people the chance to TELL you what they want and need, stop making the assumption that you are telling them what they want to hear. And when someone shares what they need, use their words in your reply to help them feel listened to.

This does 2 things firstly it helps them feel respected (and that is good for relationship building) and 2 it allows you to hear to gain vital clues as to what they business owner is looking for. That enables you to tailor your conversation to be heavy in what they want.

With online networking it’s fine to message people in the chat to keep the conversation going and to learn more (If you can’t listen to 2 people at once, then this is not advisable. You can look distracted and uninterested.)

Even if the event doesn’t have elevator pitches – prepare one anyway. This enables you to focus on what you want to talk about today and prepares you in case the opportunity does come up. People make the mistake of thinking elevator pitches need to be heavy on what you do, they don’t. Talk about what’s in the news, success stories – the good old this was their problem, this is what we did and this is what they get. And if you can include real statistic and real figures then reinforces that you really are exceptional at what you do. If you are lousy at 60 seconds take this course and like many business women you could be selling at the very next networking event you attend. Learn more here.

I could share a billion ideas here but the key to remember at the event is to be genuinely interested in other people. Don’t make the mistake of being the other end of the scale to the Jugular and be an Orbiter. Orbiter’s listen to everyone but never get around to telling people what they want. Or who they would love the chance to speak with.

Getting the balance right is key but people know you are there to do business so don’t shy away from that and be confident.

The one thing that will power up the result of your networking more than anything is your follow up process. What do you do after the event. And if you answer is “I’m too busy to do anything.” Then don’t network. What’s the point of spending 2 to 3 hours out of your working day networking if you don’t do the most crucial aspects of following up.

Your follow up style needs to reflect your personality and your business ethos. Ask yourself what that looks like.

Do you email them and thank them for their time?

Did you talk about a great website you find useful for business and thus share it with them after the event?

Do you find them on social media?

Connecting with people online enables you to keep in touch between events. That is a great way to get to know them better so that the next time you meet you feel like its not been weeks since you spoke to each other. It’s a great way of naturally getting to know a business and what they are looking to achieve.

The key to a great networker is being all about the giving. We all know the saying Givers gain, and its true. So give, we are not talking freebies and give aways all of the place. We are talking about being a kind genuine business owner looking out for other business owners. This enables people to naturally get to know you, like you and want to work with you. As always say;

“You can’t dictate when someone buys from you but you can have a say in who they chose to buy from.”

Mandie Holgate

Remember the average person knows 250 people in person and thousands online! And although many of those first hand may not need or want your products you don’t know who they know within their extensive network. Get yourself known and respected for what you do and your reputation will be a powerful way to network and get your business known and loved. Ready to supply you with a funnel of new leads and sales!

And lastly for some online networking meeting advice. Click here.

Top Tips To Online Networking Success

How are some business women making more money than ever and others are really struggling?

Why do some business owners hate online networking and others thrive on it?

Wherever you are on this, we can help! If you are struggling you can pay just a donation to network with us (no one will know). We also have 1 hour of coaching and mentoring for FREE from our founder Mandie Holgate. This is proving highly effective at helping business owners realise new exciting ways to sell more, create new products and services and launch them successfully. Even if your business is traditional face to face – we’ve helped companies like yours.

So here’s our top tips for networking success.

- Don’t worry about children/dogs/partners coming into view. We’ve found if anything people love getting to know the real you, the human behind the business.

- Do mute your microphone and video if you need to do something, it’s not rude to do this. People are becoming more mindful that it’s not easy working from home, so you don’t need to apologise. We get it.

- Do look at the camera as much as you can. People don’t mean to look bored or disinterested, but it can put you off if you are speaking in your slot and no one seems to be looking. If you look at the camera that person will feel like you heard them more. Weird but true!

- Do rehearse your 60 seconds as you usually would before hand. And if it is written down (it really shouldn’t be unless it a testimonial) then have it as close to the camera but out of view.

- Do check you know how to use the platform. Don’t rock up at 10am, ideally arrive a few minutes early.

- Do use the chat box to add your weblinks, social media and anything you mention. So if you talk about a great article you read, add it.

- Do check what is in shot. Does it represent your brand? Are you portraying an image that you want to portray. We’ve actually seen a pile of underwear in shot before and a plant coming out of someone’s head! It doesn’t need to be a banner to work for you. First impressions happen online too.

- Do speak slower and wait for a response to your question. Signal can vary in strength impacting on quality.

- Do mute your phone.

- Do feel free to be visual with your responses when you can’t speak. For speakers they are used to feedback and don’t get it in virtual events in the same way, likewise if you are the speaker be mindful to not ask questions that mean everyone has to un-mute their microphone and tries to speak at once, better to ask them to comment in the chat box.

- Do arrange a quick 1 to 1 call, messenger chat, etc after events during the event. That way you get that water cooler moment too.

- Do head over to the Insiders straight after the event to lay down your intentions. If you are going to network with us once a month don’t forget you get additional networking events for just £5. So it’s a great way to stay motivated and focused on the business growth strategy you created at the event. Not joined the Insiders yet?

- Do head to our social media after the event and tag us in posts that way we can check we are following you and did you know everything we see from you we like and share.

- It’s not ideal to be eating during the event. Some people even have a phobia around watching people eating so not a great first impression.

- Do have water and a cuppa lined up. You tend to talk more at a virtual event.

- Don’t turn up donning mascara or brushing your hair – look prepared and ready for action. People want professionalism even if they are happy to virtually meet your dog/children/partner.

- Be genuine, honest and passionate – they come across powerfully.

- Do attend regularly. Even online events are a great way to get known and to connect with potential customers. If you aren’t in the virtual room you could miss out to someone else.

- Don’t connect with new people and tell them how you can help them. We are sure you can but don’t start a relationship that way, build trust and respect first.

- Do check the quality of your sales funnel – if you are networking and people are connecting on social media, what do you do to build that relationship? To discover their needs? To discover their aims. If you aren’t sure what a sales funnel is this course could help – remember as an Insider you get 70% off of all these courses! Learn more here.

And lastly do let us know how you get on? We love your success stories and publish them for our business owners to be inspired by.

A Few Personal Finance Tips for the Busy Businesswoman

It’s easy to think of the modern businesswoman as someone who has all of her finances in perfect order. Despite the fact that women still aren’t supported in business as much as their male counterparts (Our Founder Mandie Holgate is speaking at an event for NatWest related to the Rose Review that raised to concerns over the way funding is given to female entrepreneurs and the obstacles women face). The Telegraph wrote last year that women entrepreneurs are now opening businesses faster than ever before. This contributes to what is ultimately a very positive perception — that of legions of capable, driven women setting off on their own and opening new companies.

In many cases, women like this are undoubtedly very much on top of their finances. But we should also recognise that business savvy and entrepreneurial spirit involve different skills and inclinations than personal financial strategy. Furthermore, many women who are successfully launching businesses are awfully busy, making it difficult to devote real energy toward things like savings or investments.

Because of all this, we wanted to suggest a few personal finance tips specifically for women who might typically be too busy to given these topics too much thought. Hopefully, this will help you to make the most of those hard-earned business profits!

Save With Purpose

We all know that it’s wise to save money when we can. But there is a difference between passive and active saving, and a businesswoman looking to maximise her personal financial potential should practice the latter.

Fortunately, learning to save accurately is really just a matter of mindset. Our past article “Why Savvy Women Save” addressed this mindset with a number of helpful questions and considerations that can help any women to start looking at savings differently. For the most part though, it all boils down to being mindful of potential future needs, budgeting carefully, and finding opportunities to avoid expenses in favour of savings. Those steps can fairly quickly lead you toward a habit of putting more money away, and once you start to build up those savings you can focus on how to keep them secure (and maybe appreciating) for the long term.

Automate Your Budgeting

We just mentioned “budgeting carefully” as a step toward generating savings. And if you’re running a business, chances are you already have a little bit of budgeting savvy. But there’s a difference between managing personal and business finances — and you might not have the same amount of time to put toward the personal end of things.

The good news is that you can basically automate your budgeting these days. This is something you may have even tried with regard to managing business finances. But on the personal level too, you can try a number of different apps and software programs packed with financial management features. These programs can link to your accounts, factor in your planning and preferences, and create full analyses of what you’re making, what you’re spending and saving, and what changes you might need to make. They’ve made it so easy that this is really something everyone who cares about personal finance ought to take advantage of.

Automate Your Investments

Women taking charge of personal finances should also consider investing, though this is certainly something active entrepreneurs have little time. As with personal budgeting though, investing can now be automated — at least to some extent.

This is something that we see primarily in the forex market, where FXCM details the progress that’s been made with trading “robots.” These are programs that can take into account an investor’s preferences and directions and then conduct trades on their own. Basically, you as the investor can input your general strategy, and the bot can do the heavy lifting (and do so more efficiently and exactly than a human trader would anyway). This general sort of practice isn’t entirely exclusive to Forex trading either. Some mobile investment apps now use somewhat similar tools to facilitate stock market investment as well.

In short, you now have ways of putting your income to work for you without having to devote the time and energy to investment that you might have in the past.

Value Your Time Above All Else

Last but not least, we’ll implore all women entrepreneurs to value your time. To some extent, this is about making the most of your minutes on the job, and maximising productivity. Framing an argument around the adage that “time is money, Inc. covered this idea as a means of minimising little failures. Essentially, you can figure out where and when you’ve fallen short, assess how you applied your time related to that episode, and then apply your time more appropriately on the next project.

That’s a valid way to think about your time on the job. But with more direct regard to finances, you should also place an appropriate monetary value on your time. Entrepreneurs tend to get in the habit of working long hours and almost thinking of themselves as separate from their businesses. You might feel that you oversee your business, rather than participating in it. But the truth is that you are setting yourself up as your own employee, and if you don’t compensate yourself fairly, you’ll lay a poor foundation for how you will ultimately benefit from the company.

This doesn’t mean you have to give yourself a massive salary, nor that you can’t sacrifice some for your business. But don’t fall into the trap of feeling that you owe your time to the business regardless of financial benefit!

Hopefully these tips can help you to get the most out of your business ventures. Managing personal finance while running a company is difficult, and there’s no shame in being inefficient about it. But there are ultimately some fairly straightforward steps you can take to do better in this area.

What The SEISS Extension Means For You

In the early stages of lockdown, the government announced support for sole traders in the form of the Self-Employment Income Support Scheme, or SEISS.

Just a month after its announcement, 2 million claims were made, totalling £6.1 billion in government support. And now, with a second grant opening in August 2020, a number of sole traders are set to benefit from further financial assistance.

We’ve asked Mike Parkes from GoSimpleTax to explain the terms and help you claim.

How does SEISS work?

The scheme is available to all self-employed individuals that have been adversely affected by COVID-19. This is provided that they:

- Earn the majority of their income through self-employment

- Have average annual trading profits of less than £50,000

- Have filed a tax return for the 2018/19 tax year

- Have traded during the 2019/20 tax year and intend to continue trading in 2020/21

To determine whether or not you were affected by COVID-19, any of the following must apply:

- Government orders have meant that your trade or industry had to close or be restricted in such a way that your trade closed – or is otherwise adversely affected

- You cannot organise your work, or your workplace, to allow staff to work safely

- Your staff or customers are no longer able to purchase from you due to restrictions

- Social distancing has meant that you are not able to safely serve customers

- You’ve had contracts cancelled as a result of COVID-19

- You have either had to care for others since lockdown or have been self-isolating

The first grant ended on 13th July 2020, and claimants could receive either £7,500 or 80% of their average monthly profits over the 2016/17, 2017/18 and 2018/19 tax years (whichever is the lower amount). Applications for the second grant will open on 17th August 2020, but you must have confirmed by 14th July 2020 that you have been adversely affected by COVID-19.

Why is there a phase two?

While the government set a three-month cap on the support, it has since been agreed that COVID-19 is still impacting the earnings of some sole traders. As a result, it is necessary for them to receive another grant in order to stay afloat.

It will also help to support those who may not have initially been affected by lockdown (and so did not claim the first grant) but have subsequently suffered a loss of business.

What’s the difference?

The differences between phase one and two are limited, although the second grant will be worth 70% of your average monthly trading profits. It’ll still be paid out in a single instalment that covers three months’ worth of profits, but will be capped at £6,750 total – almost £1,000 less than the phase one grant.

Additionally, you can only claim the second grant if your business was adversely affected on or after 14th July.

Can I continue working and still claim?

Yes, you can continue to work as long as you intend to continue trading in 2020/21 in the self-employed role you’re claiming for. You can even take up other employment if necessary, provided that the SEISS payments still cover the majority of your income. HMRC will not penalise you for topping up your income with a little additional earnings to sustain your household.

Phase two will have a deadline of 19th October 2020. You can find out more about it on the GOV.UK site. If you are still losing out on income or opportunities to earn, we massively recommend you claim the second grant. This is unprecedented levels of government support and could make the difference between staying afloat or falling behind.

About GoSimpleTax

GoSimpleTax software submits directly to HMRC and is the solution for freelancers and the self-employed alike to log all their income and expenses. The software will provide you with hints and tips that could save you money on allowances and expenses you may have missed.

Trial the software today for free – add up to five income and expense transactions per month and see your tax liability in real time at no cost to you. Pay only when you are ready to submit or use other key features such as receipt uploading.

INsiders members receive a 15% discount – to get your discount code simply sign-up to try our software above and it will be emailed to you.

Not an Insider yet? Sign up here.

Ask for J campaign

The National Domestic Abuse helpline has seen a 25% increase in calls and online requests for help since the COVID 19 lockdown, it received hundreds more calls in the first week compared to two weeks earlier and has continued to do so.

The Home Office has advised after a deep dive of National helpline calls that most victims are women calling to find out how to leave after lockdown therefore we could experience a spike in Essex during the loosening of the restrictions.

Safer Places have secured funding via the Office of the Police and Fire commissioner for Essex to provide a means of disclosure for victims of Domestic Abuse in 20 towns across Essex.

The Ask for “J” campaign will run alongside the main J9 objective in Essex but will be focused on businesses, retail and other outlets that victims visit, the “Ask for J” campaign will ensure victims of DA have a place to find help and survive not only during loosening of COVID 19 restrictions but the abuse that they and their families may be experiencing in the future as an ongoing initiative.

Using the “Ask for J” code word in hairdressers, beauticians, nurseries, vets, supermarkets, pharmacies, food banks for example will give victims of domestic abuse access to resources to make decisions or a safe place to make a call to a support agency, Police or family member for example.

There will be two options for individuals asking for J:

1.When “asking for J” staff to ask “do you need to speak to J right now”, this is code that they are in immediate danger and need support right now. The individual is to then be taken into private room at the back of the shop and support will be offered via J9 resources and include help with calling the police, a local support service or their friends and family.

If they don’t need to “speak to J” right away, they will be offered a coupon (this coupon will say “20% off hair products, log online via the link to receive your code”, the link will direct them to a website with resources including safety planning etc. The coupons will feature the J9 logo and have the COMPASS number and also Safer Places 24/7 emergency number so clients will remember what the coupon is for.

This gives the individual an opportunity to look into this in their own time and make decisions.

“Ask for J” training The “Ask for J” 15 min training sessions will be delivered by Safer Places via a pre-recorded video link and are intended to raise awareness and increase knowledge and understanding of domestic abuse for staff in public and voluntary sector organisations. The training aims to ensure that staff is equipped to respond and refer. During training a Safer Places facilitator will be on hand to answer any questions or concerns. Information Pack The information pack are the main J9 information guides and are intended to be used to give options and answer questions to signpost victims of domestic abuse to the support services they need or want at the time of asking for J.

Communications Public facing communication via local facebook groups, newspaper, and local authority newsletters is imperative to allow victims to recognise the J9 sign and know this is a place of safety to disclose. Each business or organisation taking part will have posters within to also signpost to this campaign. We will need your help in each district to ensure we can reach maximum exposure to businesses getting involved and victims to become aware.

If you would like to get involved please contact j9@saferplaces.co.uk for more information.

Thinking of going self employed? Know this first

We know that due to the Pandemic many face redundancy. Here at The Business Womans Network we’ve been helping men and women set up and grow their own businesses for 11 years.

We go out of our way to find top experts here in the UK and around the world to ensure you get the very best quality advice. We can also help you access discounts on many essential services. Check out the list here.

If you join our mastermind group you get discounts to work with companies like GoSimpleTax our latest affiliate offering support to ensure you get your accountancy right even if you are on a tight budget.

Here GoSimpleTax share top advice on the decision to go self employed and what you will need to do…

At the turn of the decade earlier this year, there were over 2 million freelancers in the UK. Combined, they contribute approximately £125 billion to our economy. And as working from home has never been easier, it looks likely that the demand for self-employment will only continue to rise.

The trouble is, self-employment isn’t as straightforward as simply winning business and doing the job. To ensure you don’t incur the wrath of HMRC, you need to register as self-employed and pay your taxes correctly. What’s more, you need the right records in place should you ever fall under investigation.

But don’t be overwhelmed. In order to support your dreams of working for yourself, we’ve asked Mike Parkes from GoSimpleTax to explain everything you need to know about your tax obligations.

Register as a sole trader

Firstly, you need to set up as self-employed and register for your Self Assessment tax return. This becomes a requirement once you start earning more than £1,000 from self-employment during a tax year, so there’s no harm in getting ahead.

Your Self Assessment tax return is due every year as of 6th April with a deadline of 31st January and summarises your earnings for HMRC so that they can accurately tax you.

Assuming you haven’t previously registered as self-employed, you’ll find two options waiting for you upon clicking through to the GOV.UK site:

- Register if you have not sent a tax return before

- Register if you have sent a tax return before

As this is the first time you’ll be submitting your records in order to pay Income Tax directly to HMRC, you’ll need to choose the former. You’ll have to wait for your 10-digit Unique Taxpayer Reference (UTR) number to come through. Once it does, you’re free to activate your account and start filing.

Keep detailed records

All invoices, receipts and bank statements need to be recorded. This isn’t just for safekeeping either – you’ll need them to input the correct information on your Self Assessment tax return and in case HMRC disputes your tax return submission.

There’s an added benefit to doing this too: you’ll have better visibility of the expenses you can claim for. Expenses reduce your tax liability – in other words, they can be deducted from your self-employed income to lower the total amount of profit that you’ll pay tax on.

Travel, tools and home office equipment are perhaps the most well-known examples of expenses. However, you can also claim back on:

- Financial help – Costs like professional indemnity insurance premiums and lease payments can be claimed back, although there are rules if you’re using cash basis accounting.

- Subscriptions – If you’re required to join a trade body or any professional membership organisations, the cost of the subscription can be claimed using your Self Assessment tax return.

- Stock – Any raw materials that you need to purchase for your trade, or the direct costs that arise from producing your goods, may be classed as allowable expenses.

Get ahead with your Self Assessment

Now that you know what to record and the deadline for submitting, why wait? Far too often, self-employed workers use the 31st January deadline as a benchmark of when to file. But there’s no good in leaving your Self Assessment tax return to the last minute.

In fact, in times of economic uncertainty, it pays to file early. Filing early doesn’t mean paying early (the deadline for paying any tax you owe for the previous tax year remains the 31st January), it just means you’ll know the amount of tax you owe ahead of time. This enables you to be better prepared for the payment.

Getting organised also means you’ll avoid the penalties for not filing or for not paying your tax bill on time. When you’re just starting out as self-employed, the last thing you want is to run into any avoidable fines – or get on the wrong side of the taxman.

About GoSimpleTax

Add up to five income and expense transactions per month and see your tax liability in real time – at no cost to you. Pay only when you are ready to submit or use other key features such receipt uploading.

A simple and quick way to calculate your tax return and officially recognised by HMRC.

GoSimpleTax software submits directly to HMRC and is the solution for anyone who has income outside of PAYE to file their self-assessment giving hints and tips on savings along the way. Available on desktop or mobile application.